2024 Volume 1 Issue 2 Pages 40-47

2024 Volume 1 Issue 2 Pages 40-47

In a tourist destination, the government which expects the increase of tourists might need to develop abilities to accommodate them. Considering local economy where upper-midscale hotels whose capacities are small relative to a market compete in prices for acquiring customers in an oligopolistic market, we investigate tourism policy such that the government would attract a new hotel. The government would like to make a “feasible” policy in the sense that the attraction never leave the customers or the industry worse off. Focusing on the market where hotels including an entrant are symmetric, we show that there exists a legitimate range of hotels' capacities within which the attraction is feasible. We also explicitly find the range of hotels' capacities. Our result suggests that the government does not necessarily attract a high-class hotel such as a five star hotel (an upscale or luxury hotel) for a positive impact of the attraction. Instead, the government might still enjoy the positive impact by introducing an entrant which is similar to incumbents in terms of capacity size and brand equity without incurring vast amount costs of the attraction of a larger hotel or a high-class hotel.

【原著論文】

A Study of the Positive Impact of Attraction of a Hotel on the Local Economy

Takaomi Notsu1

2Shimonoseki City University

Abstract

In a tourist destination, the government which expects the increase of tourists might need to develop abilities to accommodate them. Considering local economy where upper-midscale hotels whose capacities are small relative to a market compete in prices for acquiring customers in an oligopolistic market, we investigate tourism policy such that the government would attract a new hotel. The government would like to make a “feasible” policy in the sense that the attraction never leave the customers or the industry worse off. Focusing on the market where hotels including an entrant are symmetric, we show that there exists a legitimate range of hotels' capacities within which the attraction is feasible. We also explicitly find the range of hotels' capacities. Our result suggests that the government does not necessarily attract a high-class hotel such as a five star hotel (an upscale or luxury hotel) for a positive impact of the attraction. Instead, the government might still enjoy the positive impact by introducing an entrant which is similar to incumbents in terms of capacity size and brand equity without incurring vast amount costs of the attraction of a larger hotel or a high-class hotel.

Keywords: Tourism policy, Attraction of hotel, Hotel's capacity, Welfare

In a tourist destination, the government which expects the increase of tourists might need to develop abilities to accommodate them.3 We investigate tourism policy such that the government would attract a new hotel. A question arises if one wants to explore the possibility of implementation of such a policy; Does the attraction have a positive impact on social welfare? This is our main interest.4 We interpret the number of guest rooms which a hotel holds as a capacity and then we study a relation between the hotels' capacities and a positive impact of the attraction.

The policy (the attraction of a new hotel) alters the structure of the market and thus our model is dynamic. But we suppose local economy where there exist upper-midscale hotels whose capacities are small relative to a market and the hotels before and after the introduction of the policy compete in prices for acquiring customers in an oligopolistic market. It is noteworthy that there are strategic interactions between the hotels in such a market. Then, we describe the market by a Bertrand competition, which is a model of game theory.5

In the Bertrand competition, each hotel charges a room price. Customers prioritize room prices and they would like to reserve at the lowest price possible.6 However, each hotel cannot accommodate customers beyond the own capacity. Who reserves at what price is in accordance with an efficient rationing rule; Under an efficient rationing rule, customers' priority of being rationed to a hotel with a lowest price is according to their willingness to pay. Namely, the customers who are more willing to pay are more likely to be rationed to a hotel with a lowest price until the total capacities of the hotels charging the lowest price are exhausted. After that, among remaining customers, those who are more willing to pay are more likely to be rationed to a hotel with a second lowest price until the total capacities of the hotels charging the second lowest price are exhausted, and the same hereinafter.7

In our model, initially, there exist

Under our assumptions of capacities, there exists a symmetric pure equilibrium in which all hotels charge a same price with probability 1 in the Bertrand competition.10 The government pays attentions to both consumer surplus and producer surplus at the equilibria in the markets.11 It intends to choose attraction which has positive impact on both consumer surplus and producer surplus. We define that the attraction is “feasible” if consumer surplus and producer surplus will never be worse off than before the entrant enters the market.12

We show that there exists a legitimate range of hotels' capacities within which the attraction is feasible. We also explicitly find the range of hotels' capacities; The attraction can be feasible when capacities of each hotel are small relative to the markets. This is our main result.

An intuition of the result is that the attraction makes hotels lower their prices through competition and as a result, consumer surplus gets better. If capacities of each hotel are too large, then they provoke fierce competition and as a result, producer surplus gets worse. On the contrary, the capacities which are not too large keep the competition mild and the profit of the entrant compensates loss of producer surplus which stems from the competition. Then, moderate capacities make the attraction feasible.

Our result suggests that the government does not necessarily attract a larger hotel or a high-class hotel such as a five star hotel for a positive impact of the attraction.13 Instead, the government might still enjoy the positive impact by introducing an entrant which is similar to incumbents in terms of capacity size and brand equity without incurring vast amount costs of the attraction of a larger hotel or a high-class hotel.

In the paper, we assume that the government controls the entrant’s capacity and quality, whereas models in which the entrant chooses its own capacity or quality is also meaningful. In such models, hotels might be asymmetric. Although analyses of the market of asymmetric hotels might resembles ours, it is slightly complicated. Further, models with fixed costs of hotels and actual negotiations or contracts which is relevant to the attraction are important. These are future researches.

We end this introduction with other literatures. Yield management (or revenue management) is well known as a way of management in hotel industry. It focuses on hotel's practices such as room pricing and it studies how expected profits of the hotels can be maximized.14 However, it does not pay attentions to strategic interactions between hotels (customers) except a few researches. In this sense, yield management and our approach are different. Some literatures (Yoshimura and Watada (2014), Watada et al. (2017) and Zhao et al. (2020)) consider the strategic interactions by using game models.15 On the other hand, the new entry of a hotel is not considered in their researches and it is studied in this paper.

The rest of the paper proceeds as follows. In Section 2, we describe our model. Section 3 is analyses and we study feasible attraction. Section 4 concludes the paper.

We describe our model. We consider the local economy where all existing hotels are upper-midscale hotels. Guest rooms which the hotels hold are assumed to be homogeneous. Each customer prioritizes prices of guest rooms when they reserve. The hotels compete in room prices for attracting customers.

Hotels are represented by natural numbers.

Given a price

The timing of game is as follows. Assuming

・State 1

・Attraction of hotel: The government attracts an entrant denoted by

・State 2

In each state, given

We assume the economy where capacities of each hotel are small relative to the market.

Assumption.

For simplicity, we use a term “Bertrand equilibrium” when we refer to an equilibrium of Bertrand competition in each state. For each state

In the sense that the government would like to make a policy which has a positive impact on both hotel customers and hotel industry, we define “feasible” attraction as follows.

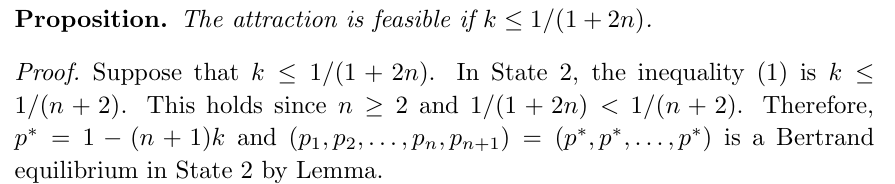

Then, we have the following proposition for a legitimate range of hotels' capacities within which the attraction is feasible.

From the proposition, we have a policy implication for the government whose ability to attract a new hotel is limited. That is, the government might still enjoy the positive impact by attracting an entrant which is similar to incumbents in terms of capacity size and brand equity even if it cannot incur vast amount costs of the attraction of a larger hotel or a high-class hotel such as a five star hotel.

We investigate tourism policy such that the government would attract a new hotel assuming local economy where upper-midscale hotels whose capacities are relatively small compete in prices for acquiring customers in an oligopolistic market. In our model,

We define feasible attraction as it never leave the hotel customers or the hotel industry worse off. Then, we show that there exists a legitimate range of hotels' capacities within which the attraction is feasible. We also explicitly find the range of hotels' capacities; The attraction can be feasible when capacities of each hotel are small to some degree.

Our result suggests that the government does not necessarily attract a larger hotel or a high-class hotel such as a five star hotel (an upscale or a luxury hotel) for a positive impact of the attraction. Instead, the government might still enjoy the positive impact by introducing an entrant which is similar to incumbents in terms of capacity size and brand equity without incurring vast amount costs of the attraction of a larger hotel or a high-class hotel.

We should study the cases where the entrant chooses its own capacity or quality and sometimes asymmetric hotels play oligopoly. Also, fixed costs of hotels and negotiations or contracts between the government and the entrant are issues to be analyzed. These are future researches.

Conflict of Interest: The author has no conflict of interest.

References

Brock, W.A., Scheinkman, J.A.,1985. “Price setting supergames with capacity constraints”, Rev. Econ. Stud. 52, pp.371-382.

Gibbons, R., 1992. “Game Theory for Applied Economists”: Princeton University Press.

Klein, R., Koch, S., Steinhardt, C., Strauss, A. K.,2020. “A review of revenue management: Recent generalizations and advances in industry applications”, Eur. J. Oper. Res. 284, pp.397-412.

Levitan, R., Shubik, M.,1972. “Price duopoly and capacity constraints”, Int. Econ. Rev. 13, pp.111-122.

Mas-Colell, A., M.D. Whinston, J. R. Green., 1995. “Microeconomic Theory”: Oxford University Press.

Notsu, T., 2023. “Collusion with capacity constraints under a sales maximization rationing rule”, Int. J. Game Theory 52, pp.485-516.

Shaked, A., Sutton, J., 1982. “Relaxing Price Competition Through Product Differentiation”, Rev. Econ. Stud. 49, pp.3-13.

Watada, J., Yoshimura, K., Vasant, P., 2017. “A Bertrand Game-Based Approach to Hotel Yield Management Strategies”, Handbook of Research on Holistic Optimization Techniques in the Hospitality, Tourism, and Travel Industry, pp.27-66

Yoshimura, K., Watada, J., 2014. “Game-based strategy development for hotel yield management”, Innovative Management in Information and Production, pp.377-386.

Zhao, Z., Chen, M.H., Su, C.H., Tian, Li., 2020. “Asymmetric price responses to hotel competition caused by heterogeneous customers' willingness to pay”, Int. J. Hospitality Management 90, Article 102409.

∗ Department of Economics, Shimonoseki City University (email: notsu-ta@shimonoseki-cu.ac.jp). We are grateful to anonymous two referees for helpful comments.

∗ Department of Economics, Shimonoseki City University (email: notsu-ta@shimonoseki-cu.ac.jp). We are grateful to anonymous two referees for helpful comments.

For instance, Ministry of Tourism gives subsidies for setting up new hotels in some states in India.

Yamaguchi City has been selected for the list of “52 Places to Go in 2024” in The New York Times (https://www.nytimes.com/interactive/2024/travel/places-to-travel-destinations-2024.html). Many tourists might come to the area around Yamaguchi City from abroad in the near future. An objective of the paper is to contribute to the governments of the area around Yamaguchi City including Shimonoseki City by proposing a tourism policy implication for attracting a new hotel.

Game theory is a useful tool to analyze behavior of strategic economic agents. In game theory, “(Nash) Equilibrium” is a standard solution concept. As usual in game theoretic analyses, we base analyzing an equilibrium of a Bertrand competition on the paper. For details of game theory and the concepts of equilibria, see for example, Gibbons (1992).

We assume that customers who have booked show up without fail and they stay at the booking price.

For details of an efficient rationing rule, see for example, Levitan and Shubik (1972), which consider price competition models with capacity constraints.

Symmetric means that hotels' capacities and the costs of providing services are the same among hotels.

If the entrant and the incumbents are different types of hotels in terms of brand equity and brand recognition, it is not suitable to describe the market by the Bertrand competition.

Such an equilibrium is characterized by the total capacities of the hotels. We have this result by applying Brock and Scheinkman (1985) and Notsu (2023).

Surplus is a measure of welfare. For details, see for example, Mas-Colell et al. (1995).

If the attraction makes at least one agent surplus worse off, then it is not feasible. This means that such a policy does not support from an agent whose surplus gets worse because of the attraction.

This is the case if the government has the power to decide the entrant’s capacity and quality. To the contrary, if the government allows the entrant to choose its capacity or quality, then we should study a model with a decision stage of the entrant. For example, it would be like something which follows Shaked and Sutton (1982).

For recent researches of yield management, see for example, Klein et al. (2020).

Yoshimura and Watada (2014) and Watada et al. (2017) combine game models with yield management. Zhao et al. (2020) assume an oligopolistic market and analyze price adjustment in hotel industry.