2023 Volume 5 Issue 3 Pages 57-64

2023 Volume 5 Issue 3 Pages 57-64

The international competitiveness of Japan in drug discovery is low. Among the companies responsible for discovering new drugs approved by the US Food and Drug Administration (FDA) from 2017 to 2021, in the United States and Europe, bio-ventures established in the 1990s or later accounted for approximately half to one-third of the total. In contrast, all approved drugs originated by Japanese companies were discovered by long-established pharmaceutical companies. As seen in the bio-ventures that developed multiple new drugs during the same period and the research and development of COVID-19 mRNA vaccines, an established drug discovery ecosystem exists in the United States and Europe to support the creation of innovative new drugs through the establishment of ventures by researchers based on promising technologies from academia, attracting substantial investments from investors and large corporations. Conversely, measures to promote university ventures have not been effective in Japan, and academic drug discovery, implemented as an alternative measure, has not yielded satisfactory results. From analyzing a domestic pharmaceutical company that has developed several FDA-approved drugs, it was found that promoting the alignment between modality technology development by pharmaceutical companies and novel drug targets discovered through academic biological research can be an effective strategy for advancing drug discovery in Japan. Based on these findings, this paper discusses perspectives for enhancing the competitiveness in drug discovery in Japan.

In the United States and Europe, bio-ventures play a significant role in new drug discovery. In contrast, the bio-venture ecosystem has not been fully established in Japan, and academic drug discovery has yielded insufficient results. Based on a domestic pharmaceutical company with high research productivity, it was found that promoting the alignment between the industry’s modality technology and academia’s biological research results is an effective strategy to overcome this problem.

The international competitiveness of Japan in drug discovery is low. According to the data compiled by the Japanese Science and Technology Indicators 2022 [1], the Japanese pharmaceutical industry has been running a trade deficit for at least the past thirty years. The increasing trend in import excess surpassed three trillion yen in 2021 (Fig. 1). In 2021, the trade balance ratio, the ratio of exports to imports, was approximately 0.2, indicating that imports exceeded exports by approximately five times.

Annual Changes in the Pharmaceutical Trade Balance and Trade Balance Ratio in Japan.

According to the Trade Statistics of the Japan Ministry of Finance [2], the trade balance of pharmaceutical products in 2022 further worsened and resulted in an import surplus of approximately 4.6 trillion yen, which can be attributed to the import of COVID-19 vaccines. The COVID-19 vaccines developed by Moderna and BioNTech/Pfizer are highly innovative drugs created using a novel medical modality called mRNA therapeutics. Japan has also lagged behind in this field of technological development. A survey conducted by the Office of Pharmaceutical Industry Research [3] showed that out of the top 100 drugs in global sales in 2021, only nine were discovered by Japanese companies, and only two of these nine drugs were biopharmaceuticals, which have gained prominence in the pharmaceutical market in recent years. Thus, Japan lags behind the United States and Europe in creating innovative pharmaceuticals using new technologies, leading to a continuous decline in the international competitiveness of drug discovery.

This review discusses the current status of drug discovery in Japan by analyzing the differences among countries in the players involved in new drug discovery. Furthermore, the history of bio-venture promotion measures and academic drug discovery in Japan are reviewed, emphasizing the challenges faced in this field. Subsequently, potential strategies for enhancing the competitiveness of Japan in drug discovery are discussed, drawing on the example of a pharmaceutical company with high drug discovery productivity. In addition, this review explores the future directions for Japan’s efforts to strengthen its drug discovery capabilities.

The pharmaceutical industry, known as a “Science-based Industry”, heavily relies on the scientific advancements generated by universities [4]. Bio-ventures originating from universities have played a crucial role in discovering innovative drugs [5]. A survey conducted by the author found that bio-ventures established in the United States and Europe in the 1990s or later significantly contributed to new drug discovery. In contrast, all The Food and Drug Administration (FDA)-approved new drugs were discovered by long-established pharmaceutical companies in Japan [6]. Figure 2 illustrates the distributions of establishment periods of companies responsible for discovering new FDA-approved drugs between 2017 and 2021, categorized by region in the United States, Europe, and Japan.

Distributions of the establishment periods of originator companies of FDA-approved new drugs from 2017 to 2021, in the United States, Europe, and Japan.

FDA: The Food and Drug Administration.

Figure 2 shows that bio-ventures of less than 30 years old account for approximately half of the newly approved drugs in the United States, whereas in Europe, they contribute to about one-third. By contrast, pharmaceutical companies established before 1980 developed all newly approved drugs in Japan. This significant difference implies that bio-ventures that can potentially contribute to new drug discovery have experienced limited growth in Japan, in contrast to those in the United States and Europe. This finding is closely related to Japan’s low international competitiveness in drug discovery.

To gain further insights into the role of bio-ventures in new drug discovery, Table 1 presents three highly productive bio-ventures that successfully created two or more new drugs approved by the FDA from 2017 to 2021.

| Company name | Approved pharmaceuticals (compound name) | Year approved by FDA | Molecular target | Modality |

|---|---|---|---|---|

| Agios Pharmaceuticals | enasidenib | 2017 | isocitrate dehydrogenase 2 | small molecule |

| ivosidenib | 2018 | isocitrate dehydrogenase 1 | small molecule | |

| Alnylam Pharmaceuticals | patisiran | 2018 | transthyretin | siRNA |

| givosiran | 2019 | delta-aminolevulinic acid synthase 1 | siRNA | |

| lumasiran | 2020 | glycolate oxidase | siRNA | |

| Genmab | teprotumumab | 2020 | insulin-like growth factor 1 receptor | monoclonal antibody |

| tisotumab vedotin | 2021 | tissue factor | antibody-drug conjugate |

FDA: The Food and Drug Administration.

The first company is Agios Pharmaceutical, founded in 2008 by Thompson, a renowned cancer metabolism researcher, and Cantley, the discoverer of phosphoinositide 3-kinase. Agios Pharmaceuticals independently identified isocitrate dehydrogenase (IDH) as a cancer-targeting agent through genetic and metabolomic analyses and successfully developed IDH1 and 2 [7, 8]. The second company is Alnylam Pharmaceuticals, a pioneer in small interfering RNA (siRNA) drugs that was established in 2002 by the Nobel Prize winner Phillip Sharp. Alnylam Pharmaceuticals capitalized on the discovery of RNA interference in 1998, demonstrating the control of gene expression through double-stranded RNA, a principle that has been advanced further in the field of drug development. In 2018, their siRNA drug patisiran received FDA approval, followed by givosiran and lumasiran as siRNA drugs [9, 10]. The third company, Genmab, was established in 1999 as a spinout from Medarex, a leading antibody-based drug company founded in 1987 by the immunologists at Dartmouth Medical School. Genmab has strong technological capabilities in antibody-based drugs. In addition to the drug teprotumumab mentioned in Table 1, Genmab received FDA approval for several antibody-based drugs prior to 2017. Recently, Genmab has successfully developed bispecific antibodies and antibody-drug conjugates. As shown in Table 1, the antibody-drug conjugate tisotumab vedotin received FDA approval in 2021 [11].

From the aforementioned examples, it is evident that in the United States and Europe, leading academic researchers often establish bio-ventures and successfully develop new drugs using their own drug targets and advanced drug discovery technologies. This established framework allows the incubation of advanced science and technology from universities within bio-ventures, leading to significant contributions to new drug discovery. However, a robust drug discovery ecosystem has yet to be established in Japan. Incumbent pharmaceutical companies in Japan continue to internally select drug targets and develop drug technologies. This situation may delay the application of cutting-edge science and technology from academia to drug discovery, ultimately contributing to Japan’s weaker drug discovery capabilities than those of Western countries.

The COVID-19 mRNA vaccine serves as an exemplary case in which a bio-venture applies innovative pharmaceutical technologies of academia to drug discovery. Initially reported at the end of 2019, the coronavirus disease 2019 (COVID-19) outbreak rapidly spread worldwide. However, within one year, in December 2020, the FDA authorized the practical use of COVID-19 vaccines developed by BioNTech and Moderna [12]. These vaccines, both utilizing mRNA therapeutic technology, represent the first approved drugs for this modality [13]. mRNA vaccines offer shorter lead times for synthesis and manufacturing than conventional vaccines, enabling faster development [14]. Given the urgent need for rapid vaccine development and deployment during the explosive spread of COVID-19, the creation of mRNA vaccines by BioNTech and Moderna can be considered a breakthrough innovation in which new pharmaceutical technology has rescued the human crisis. Conversely, despite attempts by a Japanese pharmaceutical company to develop mRNA vaccines during the same period, their development lagged significantly behind that of BioNTech/Pfizer and Moderna. Consequently, Japan had to rely on vaccine imports, leading to further expansion of the trade deficit in drugs, as mentioned above. Which factors enabled BioNTech and Moderna to succeed in the practical application of mRNA technologies ahead of the rest of the world? To answer this question, I analyzed published academic articles, patent filings, and clinical trials conducted by BioNTech and Moderna concerning mRNA therapeutics [15].

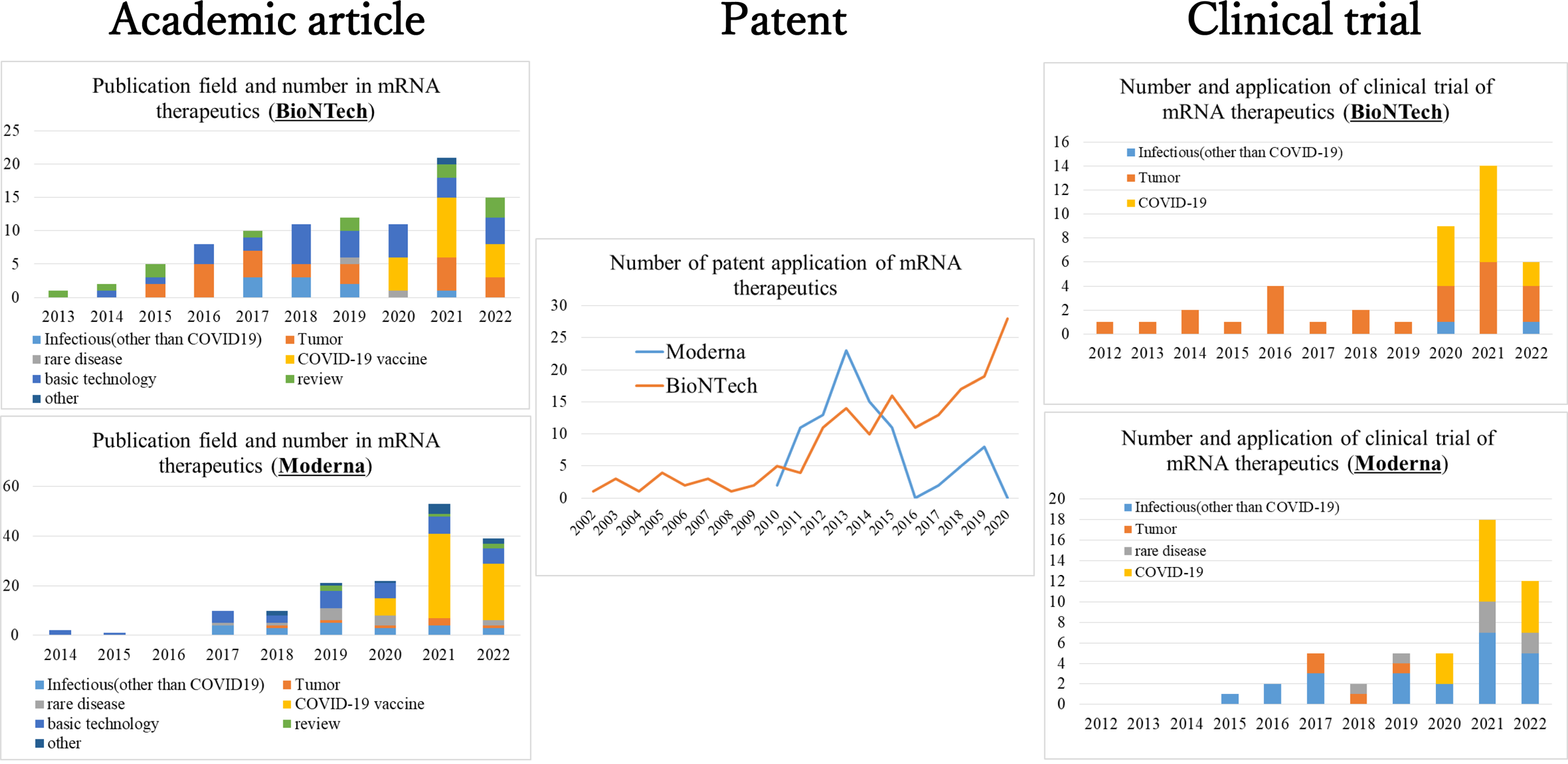

BioNTech is a bio-venture co-founded in 2008 by Ugur Sahin and Özlem Türeci. They conducted cancer immunity research at the university and initiated research on cancer vaccines using mRNA since the 1990s. Since 2013, BioNTech has consistently published academic articles, many of which focused on the fundamental technologies of mRNA therapeutics and their applications in cancer treatment (Fig. 3, top left). Moreover, research articles on infectious diseases other than COVID-19 have been published since 2017, whereas those on rare diseases were published in 2019. Patents were filed under the name BioNTech even before its establishment, with continuous patent filings related to mRNA structural optimization, delivery, manufacturing, and others until 2020 (Fig. 3, center). Clinical trials for mRNA vaccines have been consistently conducted since 2012, and all clinical trials conducted until 2019, prior to the COVID-19 outbreak, focused on the field of oncology (Fig. 3, top right). In 2005, Kariko et al. made a significant technological breakthrough by discovering that converting uridine residues to pseudouridine greatly attenuated the innate immune activation ability of mRNA, thus paving the way for its utilization as a drug [16]. BioNTech invited Kariko to join in 2013, thereby acquiring expertise in state-of-the-art medical technology related to mRNA.

Records of academic articles, patents, and clinical trials on mRNA therapeutics by BioNTech and Moderna (adapted and reproduced from Okuyama R. 2022. Pathogens 11 (12):1469).

Moderna is a bio-venture founded in 2010 by stem cell researcher Derrick Rossi. Rossi was inspired by the potential of mRNA therapeutics after reading an article by Kariko, and founded Moderna. Moderna has published academic articles since 2014. Until 2019, prior to the COVID-19 outbreak, the majority of these articles focused on the fundamental technologies of mRNA therapeutics. Additionally, they have published articles on the treatment of various diseases, including infectious diseases (other than COVID-19), rare diseases, and cancer (Fig. 3, bottom left). Patents were filed starting in 2010, when Moderna was founded, and by 2016, numerous patents related to the fundamental technologies of mRNA therapeutics had been applied for, with a peak in 2013 (Fig. 3, center). Clinical trials commenced in 2015, and until 2019, before the outbreak of COVID-19, primarily targeted infectious diseases as well as cancer and rare diseases (Fig. 3, bottom right).

Therefore, BioNTech and Moderna were actively engaged in the research and development of mRNA therapeutics for approximately a decade prior to the emergence of COVID-19. While both companies continuously advanced the basic technological development of mRNA therapeutics, BioNTech focused on the clinical application of cancer vaccines, whereas Moderna explored various possibilities, including infectious diseases (other than COVID-19), rare diseases, and cancer. The accumulation of technological developments over the last decade likely enabled the rapid development of mRNA vaccines when COVID-19 emerged. In contrast, a pharmaceutical company in Japan initiated the development of a COVID-19 mRNA vaccine at approximately the same time. However, in a similar investigation, no academic articles or patents related to mRNA therapeutics were found using the same search methods, and the conduct of clinical trials involving mRNA therapeutics before the COVID-19 vaccine was not confirmed [15]. Hence, it can be inferred that there was a significant disparity in the accumulation of technological and clinical developments in mRNA therapeutics among BioNTech, Moderna, and the Japanese pharmaceutical company prior to the occurrence of COVID-19. This disparity has resulted in a substantial delay in the development of COVID-19 mRNA vaccines in Japan.

In the United States and Europe, bio-ventures have received significant investments in the development of advanced technologies. Upon its foundation, BioNTech received substantial investment from Struengmann, a prominent investor [17], and secured $270 million in Series A financing in 2018 [18]. Despite not having marketed any drugs prior to the COVID-19 vaccine and experiencing a significant deficit in revenue, BioNTech managed to survive by attracting investments that exceeded the deficit. Similarly, Moderna received support from Langer, a renowned chemical engineering researcher and entrepreneur, and backing from Afevan, a prominent venture capitalist, at the time of its establishment. In 2013, Moderna raised $450 million from the market [19] and secured $1.9 billion in joint research funding from major pharmaceutical companies such as AstraZeneca, Alexion, and Merck between 2013 and 2014 [20]. A drug discovery ecosystem has been established in the United States and Europe, wherein leading researchers establish bio-ventures based on promising technologies from academia and substantial investments are made to support long-term research and development towards drug applications. This ecosystem plays a crucial role in facilitating the practical applications of advanced science and technology.

In Japan, as well as in other countries, the importance of transferring academic research results into innovative products and continuously generating new market has been recognized as a key factor for sustaining economic development. In 2001, the Ministry of Economy, Trade and Industry in Japan published the “Policy for creating 1,000 university startups”, which led to a significant increase in the number of university ventures from approximately 500 at that time to nearly 1,500 in 2005 [21]. However, the number of university ventures peaked around 2008 and remained stagnant for approximately ten years thereafter [21]. Furthermore, a survey conducted in 2019 revealed that the average number of full-time employees in Japanese university ventures was 9.4, with most companies reporting no operating profits. Notably, none of the companies recorded profits of 1 billion yen or more [21]. In other words, although there was a temporary increase in the number of university ventures after 2001, this growth was not sustained, and the majority of these were small-scale ventures that struggled to achieve successful management. Approximately half of these university ventures are categorized as bio-ventures. Considering the findings on FDA-approved new drug originator companies, it is difficult to assert that venture companies have had a significant impact on the Japanese drug discovery ecosystem.

In Japan, where venture growth is limited, alternative mechanisms are required to bridge the gap between universities’ basic research and drug discovery. One solution is for the Japanese government to promote academic drug discovery. Academic drug discovery involves academic researchers independently conducting drug discovery research until the development of drug candidates, with the goal of licensing them to pharmaceutical companies. In 2011, the Office of Medical Innovation in the Cabinet Secretariat proposed the concept of a “Pharmaceutical Discovery Support Organization”. Under the government’s initiative, the academic drug discovery model has been promoted as a means of overcoming challenges commonly referred to as the “Valley of Death” in drug discovery research [22]. This approach was also continued under the subsequent administration of the Liberal Democratic Party (LDP), which recognized the importance of utilizing academia’s drug discovery seeds as a key strategy in the “Five Year Strategy for Creation of Innovative Drugs and Medical Devices”. To facilitate these efforts, cross-sectional initiatives, such as establishing a drug discovery support network, have been promoted under the guidance of government bureaucrats [22]. Universities at the forefront of academic drug discovery were incorporated in 2004 and were subsequently expected to make direct contributions to society. Some universities have begun to actively promote academic drug discovery as part of their commitment to social contribution through research achievements [22]. However, pharmaceutical companies do not have high expectations of drug candidate compounds originating from academic drug discovery. To shed light on the actual situation, we examined and analyzed the clinical development status of drug candidates discovered through academic drug discovery from 2009 to 2014 (Table 2).

| Developer | ||

|---|---|---|

| Academia (not yet out-licensed) | Pharmaceutical company | |

| Total number | 37 | 7 |

| Status of clinical development | ||

| Discontinued | 21 | 0 |

| Preclinical | 21 | 0 |

| Phase 1 or after | 0 | 0 |

| On-going | 16 | 7 |

| Developmental stage: Preclinical | 15 | 6 |

| Phase 1 | 1 | 0 |

| Phase 2 | 0 | 1 |

| Disease area | ||

| Oncology | 26[11] | 1[1] |

| Cardiovascular | 1[1] | 1[1] |

| Metabolism | 2[0] | 0[0] |

| Central nerve | 3[1] | 0[0] |

| Immune & Inflammation | 1[1] | 1[1] |

| Eye | 0[0] | 1[1] |

| Infectious disease | 4[2] | 1[1] |

| Rare disease | 0[0] | 2[2] |

| Modality | ||

| Small molecule | 35[15] | 2[2] |

| Antibody | 1[1] | 0[0] |

| Protein/Peptide | 1[0] | 2[2] |

| Gene therapy | 0[0] | 3[3] |

Number in [ ] shows compounds under development.

The analysis revealed that of the forty-four drug candidate compounds for which data were collected, only seven were successfully licensed to pharmaceutical companies. Twenty-one of these compounds were discontinued in the preclinical stage. Among the thirty-seven compounds that were not licensed, twenty-six were focused on cancer treatment, with the majority being small-molecule compounds, which indicates a lack of promotion for licensing candidate compounds from academic drug discovery to pharmaceutical companies in disease areas and pharmaceutical modalities, where these companies are currently emphasizing and hold an advantage [22]. Furthermore, the authors’ analysis revealed a significant difference in the probability of market launch between drug candidate compounds discovered through joint industry-academia research and those discovered solely through academic drug discovery during subsequent clinical development. This suggests that academic drug discovery should focus on improving drug application research, which is a strength for pharmaceutical companies [23]. Thus, many drug discovery projects conducted by academia have focused on similar disease areas and modalities as those pursued by pharmaceutical companies and have faced challenges in successfully creating drug candidate compounds that can be licensed to pharmaceutical companies, partly because of the limited capability in application research within academia. In Japan, where the growth of bio-ventures has stagnated, academic drug discovery has been considered a potential alternative. However, a mechanism that effectively connects academic research results to drug discovery applications has not yet been fully realized. In contrast, upon investigating seven cases in which drug candidates discovered through academic drug discovery between 2009 and 2014 were successfully licensed to pharmaceutical companies, it was observed that three out of the seven compounds targeted rare diseases and three out of the seven compounds were gene therapy. These characteristics differed from those of drug candidate compounds that were not licensed by pharmaceutical companies (Table 3).

| Name of compound | Development phase | Academic organization that mainly conducted research | Company that the compound is out-licensed to | Modality | Disease area | Public funds |

|---|---|---|---|---|---|---|

| AAV9-ADAR2 | Preclinical | Jichi Medical University | Gene Therapy Research Institution○ | gene therapy | Amyotrophic lateral sclerosis (ALS) | |

| AAV-mVChR1 | Preclinical | Iwate University | Clino○ Astellas Pharma | gene therapy | Retinal pigment degeneration (RPD) | |

| Ad-SGE-REIC | Phase II | Okayama University | Momotaro-Gene○ Kyorin Pharmaceutical | gene therapy | Oncology | JST NexTEP |

| IFNα-MN(TIP) | Preclinical | Kyoto Pharmaceutical University | CosMED Pharmaceuticals○ Otsuka Pharmaceutical | protein | Virus infectious disease | |

| K-811 | Preclinical | The University of Tokyo | Kyowa Hakko Kirin | small molecule | Amyotrophic lateral sclerosis (ALS) | |

| LT-0201 | Preclinical | Kumamoto University | LTT Bio-Pharma○ | small molecule | Inflammatory disorder | |

| prothymosin-α-derived peptide | Preclinical | Nagasaki University | Shin Nippon Biomedical Laboratories (SNBL) | peptide | Cerebral infarction | JST A-STEP |

○ indicates a bio-venture (according to the definition of Japan Bioindustries Association 2013 Bio-venture Statistics and Trends Report).

Although the number of cases is limited, progress has been made in the licensing of drug candidates through academic drug discovery, particularly in advanced modalities and disease areas with small markets, such as gene therapy and rare diseases. These areas are often challenging for the pharmaceutical companies to actively pursue. The significance of academic drug discovery is expected to increase through the undertaking of drug discovery projects with unique characteristics distinct from those of pharmaceutical companies.

To effectively bridge the gap between science and technology at universities and drug discovery applications in Japan, where the bio-venture ecosystem is not thriving and academic drug discovery is not well established, a mechanism to facilitate the translation process is crucial. This study found that Kyowa Kirin Co., Ltd. emerged as the Japanese company with the highest number of new drugs approved by the FDA between 2017 and 2021. Kyowa Kirin successfully originated five compounds during this period. Among these compounds, three were first-in-class antibody-based drugs, whereas the remaining two were small-molecule drugs discovered prior to the merger of Kyowa Hakko and Kirin. All molecular targets of the three antibody-based drugs were initially discovered by renowned Japanese academic researchers. Then, these drugs were successfully created by leveraging Kyowa Kirin’s expertise in antibody-based drug technology (Table 4).

| Approved drug (compound name) | Molecular target | Molecular target discoverer |

|---|---|---|

| Mogamulizumab | C-C chemokine receptor type 4 | Kouji Matsushima, et al. |

| Burosumab | fibroblast growth factor 23 | Seiji Fukumoto, et al. |

| Benralizumab | interleukin-5 receptor | Kiyoshi Takatsu, et al. |

FDA: The Food and Drug Administration.

Kyowa Kirin effectively capitalized on the strengths of unique antibody-based drug technologies, such as Potelligent technology and KM mouse technology, which were originally possessed by individual companies before the merger. This strategic combination significantly enhanced the company’s presence in antibody-based drugs [24]. Recently, the diversification of non-small molecule modalities has revolutionized drug discovery, enabling the targeting of previously challenging biomolecules, which has contributed substantially to the discovery of innovative new drugs, particularly for rare diseases [25]. The development and advancement of modality technologies have strengthened the competitive edge of drug discovery for pharmaceutical companies. Kyowa Kirin serves as an exemplary model, demonstrating the efficient generation of innovative new drugs by combining the highly competitive modality technologies of pharmaceutical companies with the discovery of advanced biomolecules by academia in Japan. This example highlights a possible direction for strengthening drug discovery capabilities in Japan, especially where the bio-venture ecosystem faces challenges.

Japan has a national innovation system in which in-house laboratories of large companies play a leading role in innovation [26]. Despite a decline in the global presence of Japanese academia in the number of academic papers and paper citations, the number of highly cited Japanese papers has increased [27]. Therefore, focusing on strengthening modality technologies and continuously engaging in drug discovery efforts using these enhanced technologies to target unique molecules identified through biological research in Japanese academia would benefit pharmaceutical companies. In other words, establishing and promoting mechanisms to facilitate the alignment between pharmaceutical companies’ modality technologies and academia’s biological research is crucial. As a result, innovative drug discovery can be accelerated in Japan, where the mechanisms for bio-ventures and academic drug discovery, which translate university research results into drug discovery, remain relatively low. For example, there is potential for collaboration between academia and industry to analyze the drug target suitability of novel proteins discovered by academic research utilizing industrial modality technologies. In this scenario, pharmaceutical companies provide their modality technologies to create lead compounds, which are then utilized by academic researchers for various analyses, such as pharmacological effects, safety assessments, and elucidation of mechanisms of action. For small-molecule compounds, some public research institutions have established compound libraries and initiated in-house screening efforts, whereas collaborative consortia among companies have been formed to support academic screenings by providing library resources. Extending similar initiatives beyond small-molecule modalities to include other therapeutic modalities is advisable. Moreover, it can be beneficial for pharmaceutical companies to openly disclose their proprietary modality technologies to academic researchers because it could facilitate academia in proposing potential target molecules for lead-compound development, enabling effective collaboration through suitable matching of interests. Initiatives of this nature are already undergoing, to some extent, through joint research solicitations by pharmaceutical companies, and further advancements in this direction are highly anticipated.

This review discussed the current situation and challenges in drug discovery in Japan, particularly in translating academic research results into drug discovery applications. New drug research and development relies heavily on advanced academic science and technology. Establishing an effective mechanism to facilitate the translation of basic academic research into drug discovery is crucial to ensure a continuous flow of new drug discoveries. In the United States and Europe, advanced research findings from universities are effectively transferred to bio-venture companies by frontline researchers and investors.

The United States and European countries have well-established ecosystems to support long-term research and technological development, leading to the efficient production of new drugs. In contrast, Japan lacks a robust drug discovery ecosystem and academic drug discovery, which has been promoted as an alternative approach, has been insufficient. Currently, new drug discovery relies primarily on the internal research and development efforts of traditional pharmaceutical companies, and the vulnerability of the aforementioned ecosystem is considered a contributing factor to the lower international competitiveness of Japanese companies in drug discovery. To ensure the sustainability of the drug discovery capabilities in Japan, establishing a mechanism to bridge the gap between academia’s advanced science and technology and drug discovery applications is urgently needed.

However, the lack of established bio-venture ecosystems in Japan can be attributed to deep-rooted social and commercial practices that are challenging to change. Factors such as the low mobility of human resources due to seniority and lifetime employment, limited entrepreneurial mindset among Japanese individuals, and scarcity of investment capital contribute to this situation. In Japan, innovation has traditionally been driven by the in-house research and development efforts of large companies. Therefore, seeking solutions that leverage existing innovation systems may be more realistic.

As exemplified by Kyowa Kirin, many Japanese pharmaceutical companies possess strong in-house technological capabilities. A potential shortcut to enhancing drug discovery capabilities in Japan lies in these companies advancing their technologies, focusing on modality technology, which has recently gained significant importance in drug discovery. By leveraging the resources and expertise of these companies, they can create candidate drugs for target molecules identified through basic academic research. To facilitate effective technology transfer, taking advantage of the geographical proximity and promoting direct face-to-face communication are essential. For Japanese pharmaceutical companies, reducing the distance between industry and domestic academia and promoting the alignment of academia’s biological research results with the industry’s modality technology development can be an effective measure.

This paper summarizes the author’s presentation at the 1st TRS Academia Consortium Symposium held on February 17, 2023, upon request from the TRS Editorial Board.

This study did not receive any specific grants from funding agencies in the public, commercial, or not-for-profit sectors.

The author declares that he has no conflict of interest to disclose.