2022 Volume 5 Issue 2 Pages 17-35

2022 Volume 5 Issue 2 Pages 17-35

Panic buying is a consumer behavior caused by negative emotions and social influences after a disaster. This study identifies (1) how panic buying occurs over time and (2) who panic buys. Based on the theoretical background of the behavioral and emotional nature of panic buyers, we conducted empirical segmentation to integrate behavioral and psychological data. This study focuses on Japanese consumer packaged goods during the COVID-19 outbreak and finds that there are two waves of increased purchases related to the timing of government interventions between February and April 2020. One of the unique features of this study is combining individual purchase data with psychological factors such as anxiety for COVID-19 and impulsiveness for unplanned purchase measured by a questionnaire survey. Another one is allowing for heterogeneity among consumers in terms of demographic or psychographic characteristics. The results show that panic buying occurred for a limited segment of consumers, that is, consumers with more purchasing experience, including female with larger families hardly panic buy and rather stockpile a little more than usual.

Panic buying is a phenomenon often seen after a major disaster, such as an earthquake (Forbes, 2017; Hori & Iwamoto, 2014) or the SARS crisis (Cheng, 2004). During the COVID-19 pandemic, panic buying emptied store shelves around the world, and understanding this phenomenon has been the focus of recent research (Kirk & Rifkin, 2020; Loxton et al., 2020; Prentice, Chen, & Stantic, 2020; Yuen, Wang, Ma, & Li, 2020). When panic buying causes products to become scarce and prices to soar, consumer welfare is affected, and long-term relationships between firms and customers are destabilized. Thus, policymakers and marketers must heed the consumer and psychology research that has examined the mechanism of panic buying during the COVID-19 outbreak (Dholakia, 2020a; 2020b; Notebaert, 2020; Novemsky, 2020).

The Oxford English Dictionary defines panic buying as “the action of buying large quantities of a particular product or commodity due to sudden fears of a forthcoming shortage or price rise.” It has long been known that people exhibit panic responses after a disaster. According to Fritz and Marks (1954, p. 30), “the term ‘panic’ has been used quite widely to describe a wide variety of ‘irrational’ behavior of individuals exposed to danger situations.” Hall, Fieger, Prayag, and Dyason (2021, p. 2) states “panic buying is not necessarily caused by a supply deficit per se, although perceptions of a future deficit are significant, but by consumers’ heightened anxiety and fear.” It is a variant of stockpiling which is modeled as a rational, forward-looking behavior (Meyer & Assunção, 1990; Sun, 2005; Sun, Neslin, & Srinivasan, 2003). However, panic buying goes beyond rational stockpiling since (1) it is a response to a state of emergency, for example, a pandemic, natural disaster, or economic crisis; (2) purchases often exceed the optimal level required for the expected shortage; and (3) the panic is often laden with negative emotions, such as anxiety or fear. Hence, the term “stockpiling” has been used when it is considered to be a rational or adaptive response, while the term “panic buying” has been used when the behavior is excessive, irrational or emotional attempt (Lee, Wu, & Lee, 2021; Rajkumar & Arafat, 2021). Panic buying also differs from “hoarding disorder,” a term that is often used in pathological contexts, such as that of a compulsive disorder (Frost & Gross, 1993; Steketee & Frost, 2003). There are several reasons why consumers panic: (1) to alleviate anxiety, fear and to control their lives, (2) as a reaction to anticipated future scarcity, and (3) in response to the buying patterns of others, for example, after seeing empty shelves or to conform to the behaviors of friends or family members (Dholakia, 2020a, 2020b; Notebaert, 2020).

Although panic buying is a common phenomenon after disasters, it was a niche research area, and recent research mentioned that there are few psychological studies dealing with it (Bentall et al., 2021; Yuen et al., 2020). In contrast, as panic buying became a serious problem in many parts of the world due to the threat of COVID-19, there is an increase in empirical research addressing individual-level psychological factors related to panic buying. However, most of the studies are based on questionnaire surveys (e.g., Bentall et al., 2021; Chua, Yuen, Wang, & Wong, 2021; Islam et al., 2021; Kemp, Kennett‐Hensel, & Williams, 2014), and it is not clear to what extent psychological factors are reflected in actual purchasing behaviors. In this study, we uniquely attempt to understand both behavioral and psychological aspects by integrating different types of data at an individual level: actual purchase data and psychographics obtained from a survey. This allows us to explain the quantitative degree of panic buying by consumers (e.g., how much more they purchased, and in which product categories the extra purchases were) and the psychological factors behind it.

In addition, the limitations are that most studies have focused on a mere one-time panic buying opportunity. In the early stages of a pandemic, more consumers may panic buy. However, it is assumed that the degree of panic buying within individual consumers will change over time. To the best of our knowledge, little is known about how individuals change their behavior in multiple panic buying occasions. By analyzing this behavior, we can understand how consumers learn from their past experiences and make their next purchases.

This empirical study aims to identify: (1) how panic buying occurs over time; and (2) who panic buys. Specifically, it focuses on two waves of panic buying in Japan and structurally classifies consumers’ buying patterns at that time. We also evaluated the contribution of consumer demographics, psychographics, and media usage to the segments. In the analysis, we first measured the magnitude of the temporary purchase increases in 173 product categories of consumer packaged goods using scanner panel data. Next, for each of these categories, we evaluated the increase in purchase amounts compared to previously for each individual and conducted consumer segmentation. To collect psychographic data, we administered a questionnaire survey to the same respondents. This hybrid approach enabled us to integrate quantitative modeling with a psychological survey.

The remainder of this paper introduces evidence from Japan on the temporary purchase increases and reviews the literature related to consumer panic buying. We then detail the research framework, explain our data and models, and present the results. Finally, the discussion section concludes the paper with a discussion of the managerial implications of our findings.

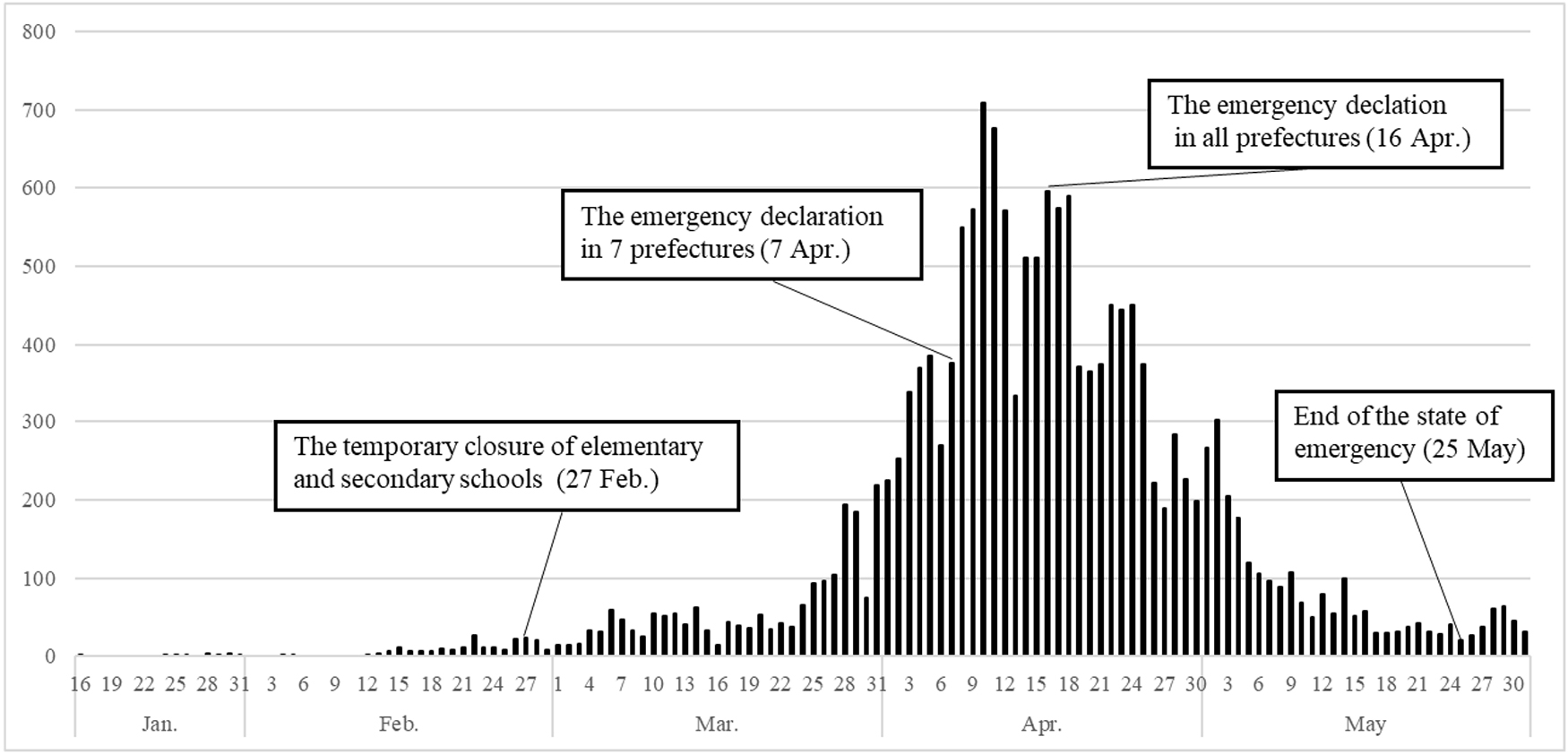

In the early stages of the COVID-19 pandemic in Japan, temporary purchase increases of consumer packaged goods linked to government interventions were observed. We begin with a timeline of the spread of COVID-19 and the two main government interventions: the temporary closure of elementary and secondary schools and the first state of emergency. Figure 1 shows the number of COVID-19 infections from January 1 to May 31, 2020 (Ministry of Health, Labor & Welfare, 2020). The first infection was confirmed in Japan on January 16. Subsequently, with the increased awareness of the COVID-19 crisis, the government issued a temporary closure of elementary and secondary schools on February 27. As the number of infections continued to rise from the end of March, the government declared the first state of emergency in major cities, including Tokyo and Osaka, on April 7, after which the declaration was extended nationwide on April 16. Consequently, the number of infections gradually declined, and the first state of emergency was lifted on May 25.

The number of COVID-19 infections in Japan.

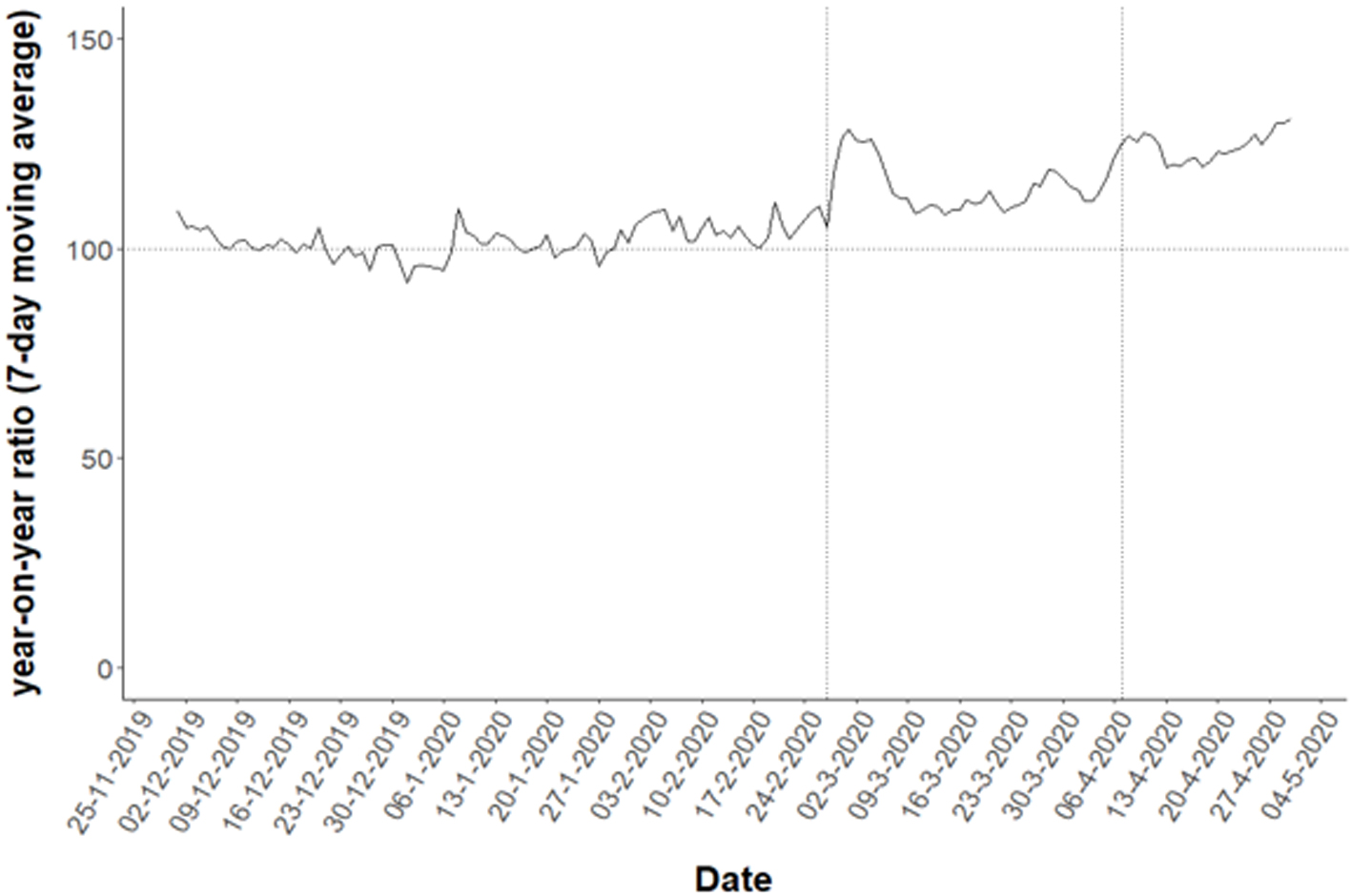

Previous research indicates that government interventions can cause temporary purchase increases (e.g., Prentice et al., 2020), and our case in Japan confirms this as well. Figure 2 shows the time series of the year-on-year ratio (7-day moving average) of the purchase amount of consumer packaged goods, which was calculated using the Syndicated Consumer Index (SCI), Japan’s largest consumer individual-level scanner panel data1). The year-on-year purchase amount ratio was computed by dividing the purchase amount per panelist on each date in 2020 with that of 2019. Based on the data, the first wave of temporary increases occurred after the declaration of school closures. The second wave was also associated with the declaration of the first state of emergency. The second wave was different from the first, in that the purchase amount did not increase immediately after the declaration of the state of emergency. The declaration was anticipated and reported extensively on television news and other media before it was issued; hence, there was an increase approximately one week before the declaration. This study focuses on the two waves of temporary purchase increases in response to these government interventions.

Time series of the year-on-year ratio (7-day moving average) of the purchase amount of consumer packaged goods. Note. The vertical line on the left represents the declaration of the school closure (February 27), and the vertical line on the right represents the declaration of a state of emergency in major cities (April 7).

Previous studies have highlighted several factors contributing to panic buying. Rajkumar and Arafat (2021) classified the factors into three categories: (1) disaster-related factors such as severity and duration of the event; (2) individual factors including psychological and informational factors; and (3) supply and demand related factors such as a limited supply of essentials. With regard to the first of these, we have already pointed out that government interventions in response to the severity of COVID-19 led to panic buying. On that basis, this study will focus on individual factors to understand the characteristics of panic buyers. Table 1 summarizes previous studies on the individual factors of panic buying.

| Paper | Factors related to panic buying | Data | ||||

|---|---|---|---|---|---|---|

| Negative emotions | Purchase characteristics | Social influence | Others | |||

| Cheng (2004) | Anxiety, Fear, Hopelessness, Distress | ✓ | Population-based survey | |||

| Gasink et al. (2009) | Worry about influenza | ✓ | Survey of clinic patients | |||

| Hori & Iwamoto (2014) | Demographics: larger number of family members, urban area, older age, homemaker wives | ✓ | Scanner panel data | |||

| Kemp et al. (2014) | Anxiety, Fear, Lack of control, Rumination | ✓ | Online survey | |||

| Khare et al. (2019) | Social media: number of tweets, Public warning of hurricane | ✓ | Tweet data | |||

| Naeem (2020) | Social media | ✓ | Telephonic interview | |||

| Yuen et al. (2020) | Perceived threat, Perceived scarcity, Fear of the unknown, Coping behavior, Social influence, Social trust | ✓ | ✓ | Systematic literature review | ||

| Bentall et al. (2021) | Demographics: male, number of children, income, Paranoia, Depression, Death anxiety, Cognitive reflection task, Personal risk | ✓ | ✓ | Online survey | ||

| Chua et al. (2021) | Perceived scarcity, Anticipation of regret, Online shopping frequency | ✓ | ✓ | Online survey | ||

| Islam et al. (2021) | Scarcity, Social media, Arousal, Urge to buy impulsively | ✓ | ✓ | ✓ | Online survey | |

| Lee et al. (2021) | Risk perception, State anxiety, Trust in social media | ✓ | ✓ | Survey of students | ||

| This paper | Anxiety Psychographics: Impulsiveness, Price consciousness, Conformity, Feelings of guilt Media usage: TV news, mobile news, social media, EC Demographics | ✓ | ✓ | ✓ | ✓ | Single source data including scanner panel data, device log data and online survey |

One of the most fundamental elements is that panic buying is accompanied by negative emotions, such as anxiety (Cheng, 2004; Kemp et al., 2014; Lee et al., 2021) and fear (Cheng, 2004; Kemp et al., 2014; Sterman & Dogan, 2015). After a natural disaster, these undesirable negative emotions can arise when an individual feels a lack of control of the situation (Kemp et al., 2014). Mawson (2005) categorized individual reactions to disasters as being triggered by anxiety when the perceived risk of physical danger is mild, and fear when it is severe. The present study deals with the period between February and April 2020, when the fear of the threat of COVID-19 was spreading among the Japanese public. Because few people were in a state of severe physical danger at that stage, our central focus is placed on anxiety. In our study, we explicitly use the terms “hoarding” and “panic buying” differently, defining panic buying as hoarding behavior conducted by consumers experiencing anxiety.

In terms of consumer purchase characteristics, panic buying is characterized by impulsive and unplanned consumer behavior (Dholakia, 2020a; Islam et al., 2021). Although impulsive buying has long been studied in consumer behavior research (e.g., Rook, 1987), panic buying is a variant of impulsive buying, in which consumers suddenly flock to stores instead of maintaining their regularly scheduled shopping. In such a situation, perceived scarcity (Chua et al., 2021; Islam et al., 2021; Sterman & Dogan, 2015; Yuen et al., 2020) and expectations of supply shortages (Yoon, Narasimhan, & Kim, 2018) cause consumers to buy things they do not really need; therefore, it is likely that panic buyers buy indiscriminately based on availability, rather than preference or price (Dholakia, 2020a).

Panic buying is also triggered by social influence. Panic buying is caused by being influenced by the actions of others, such as looking at empty shelves and listening to friends and family members (Dholakia, 2020b). The tendency to imitate or conform to the behavior of others is reflected in this behavior. Furthermore, several other studies have demonstrated the influence of the media. Naeem (2020) found that social media enhances social exchanges and develops social influences, thus increasing consumer panic buying. Naeem (2020) also implied that even though real-time information about COVID-19 on social media sites can encourage people to make smart decisions, it can also make them more anxious and lead to panic buying. Similarly, Islam et al. (2021) revealed that excessive social media use is related to panic buying during the crisis.

Research frameworkFigure 3 illustrates the present study’s conceptual framework. As noted in the previous section, there was an association between the timing of government policy interventions and the temporary purchase increases of consumer packaged goods. In particular, we focused on the two waves of purchase increases in Japan in response to the two policy interventions. However, even if there was an increase in purchases at the aggregate level of the market, each consumer’s actions would be different; therefore, we took a segmentation approach to understand the heterogeneity among consumers during this time.

Conceptual framework.

We first identified temporarily hoarded product categories. Here, we evaluated the purchase increases in response to the two policy interventions in an aggregate time series for each product category. Second, we captured consumer hoarding at an individual level; if an individual made more purchases than in the previous year, the individual is considered as a hoarder. Using the amount of an individual’s hoarding, we then conducted consumer segmentation. After the segmentation, we evaluated the members of the segment by demographics, psychographics, and media usage. This is discussed in detail in the next section.

As previously mentioned, as far as the total value of consumer packaged goods, there were two temporary purchase increase waves related to government interventions. However, those increases did not necessarily occur in each product category. Hence, we first identified the product categories that consumer temporarily hoarded, using scanner panel data (SCI); the sample size used in this analysis is 38,213, the same as in Figure 2. We obtained data for 173 categories of consumer packaged goods for the time series of the year-on-year ratio (7-day moving average) of purchase amounts from December 1, 2019, to April 28, 2020. Consumer packaged goods include groceries, beverages, daily necessities, cosmetics and drugs.

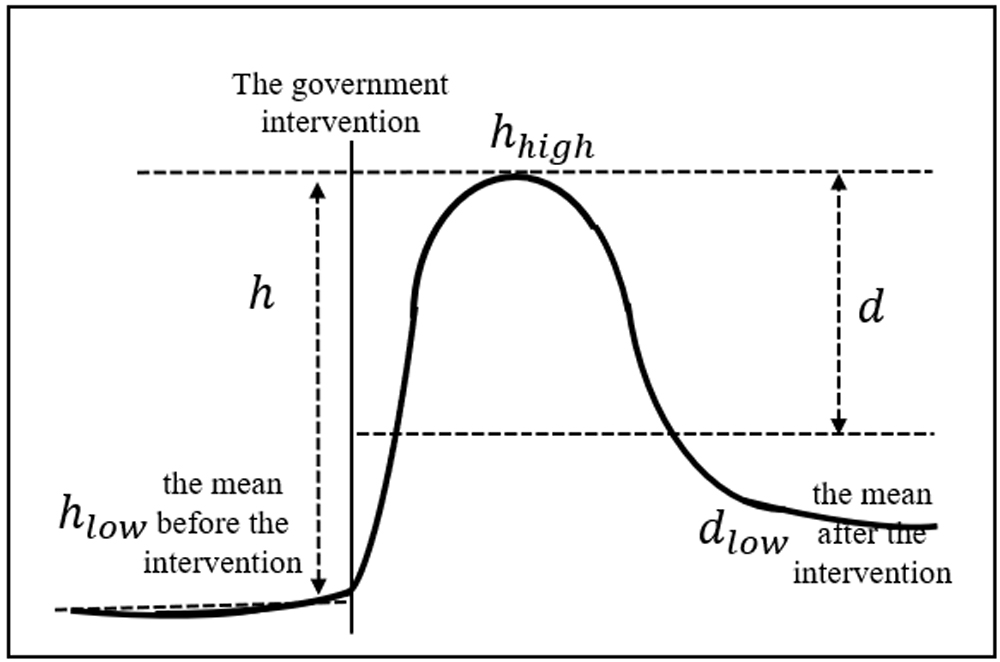

To identify the temporary purchase increases in each category, we focused on the waveforms of the time series. As shown in Figure 4, we set two conditions using the peak of the wave and the mean before / after government interventions. The first condition is the degree of increase compared to normal times. Specifically, we examined the degree of increase within short term after the government intervention compared to the mean value before the intervention. The second is to verify whether the increase is temporary or not. Specifically, we examined the extent to which purchases returned to normal using the mean value during sufficiently long term after the intervention.

Parameters for the waveform.

This study attempts to identify temporary increase from actual purchase data, but to the best of our knowledge, there has been little research on panic buying from this perspective. Therefore, with respect to the identification of the waveform, we drew inspiration from Goldenberg, Libai, and Muller (2002) in the adjacent marketing field. Goldenberg et al. (2002) parameterized the peak and trough of the waveform and identified the shape of the waveform in an a priori way2). For this operation, the variables (1) the peak of the waveform and (2) the return depth from the peak were used3). This also works well for us to capture temporary purchase increase from the waveform. However, it cannot simply be applied, so we operate it as described below.

First, we measured the peak and baseline in the waveform to capture the purchase increase (not necessarily temporary) in each category (see also Figure 4). Let hlow be the baseline, measured as the mean value from December 1, 2019 to February 26, 2020 (the day before the declaration of the school closures). Let hhigh be the peak of the wave, measured as the maximum value within two weeks of the government interventions.

Next, we confirmed whether the purchase increases were temporary. Let dlow be the return value of the waveform measured as the mean value during the four weeks after the government intervention. We set a time frame of four weeks, which is long enough to take into account the intervention interval.

| hlow | Baseline measured as the mean value from December 1, 2019 to February 26, 2020 (the day before the declaration of the school closures) |

| hhigh | The peak of the wave measured as the maximum value within two weeks of the government intervention |

| The maximum value during the two weeks from February 27 (the declaration of school closures) to March 11 | |

| The maximum value during the two weeks from April 1 (a week before the declaration of a state of emergency) to April 14 | |

| h(1) | |

| h(2) | |

| dlow | The return value of the waveform measured as the mean value during the four weeks after the government intervention |

| The mean value from February 27 to March 26 | |

| The mean value from April 1 to April 28 | |

| d(1) | |

| d(2) |

Note that the reason we defined the d conditions in this way is to remove the effect of a sustained demand increase. For example, in some product categories, the purchase increases were not temporary but continuous due to the influence of people staying at home. In this case, the waveform had a narrower peak and trough, and the value of d was smaller. Such product categories are regarded, in this study, as not temporary purchase increases related to panic buying. Added to this, we treat dlow as the mean value, not the minimum value. This is because we need to exclude the pattern of a momentarily drop and then continuing to rise again. Since the minimum value does not exclude this pattern, the mean value is appropriate.

We first calculated h and d for the total value of consumer packaged goods for the two observed waves. We then calculated these values for each category and identified the categories with temporary purchase increases in which both h and d were greater than the total value4). 52 categories in the first wave and 63 categories in the second wave were extracted (see Appendix Tables A.1 and A.2 for further details)5). We used these temporarily hoarded product categories for the subsequent analysis.

DataMultiple data tied at individual levels are used for the segmentation analysis, comprising purchase history of scanner panel data, demographics, psychographics collected via a survey, and device log data from television and mobile devices. These data were collected by INTAGE Inc., a Japanese marketing research company. The purchase history and device log data are representative panel data that have been utilized in the marketing by many companies in Japan. We further conducted a questionnaire survey on the panelists to obtain the psychographics. Ultimately, 968 respondents are included in this study.

Purchase History. For the product categories where hoarding occurred, we indexed the amount of hoarding compared to normal at the individual level. qi1 represents the purchase amount (yen) of respondent i for the corresponding categories for two weeks during the first wave (from February 27 to March 11, 2020). qi2 is the purchase amount for the corresponding categories for two weeks during the second wave (from April 1 to 14, 2020). Since qi1 and qi2 are defined by aggregating multiple categories, rather than by individual categories, the effect of purchase intervals for individual products is eliminated. Next,

| (1) |

Table 3 presents the summary statistics for these variables. Figure 5 shows the plots of the consumer hoarding indexes yi1 and yi2, which take positive values when consumption increased compared to the average purchase amount in the past year and negative values when it decreased. The correlation coefficient is 0.124, suggesting that across the sample population, the first and second waves of hoarding did not necessarily occur among the same individuals.

| mean | sd | min | max | |

|---|---|---|---|---|

| qi1 | 3050.1 | 3132.9 | 82.0 | 37938.0 |

| 2304.8 | 1695.9 | 51.1 | 11838.1 | |

| qi2 | 2922.0 | 2977.8 | 59.0 | 33016.0 |

| 2252.8 | 1728.7 | 95.9 | 15180.4 | |

| yi1 | 0.082 | 0.863 | −3.100 | 2.888 |

| yi2 | 0.054 | 0.280 | −2.774 | 3.332 |

Plot of consumer hoarding index in first and second waves.

Psychographics. The survey data were collected from April 23 to 27, 2020. As shown in Table 4, we measured the psychographic constructs using multiple items with a 7-point Likert scale ranging from 1 (fully disagree) to 7 (fully agree). The first construct is perceived anxiety of COVID-19. Anxiety is measured using three items, following Maheswaran and Meyers-Levy (1990) and Winterich and Haws (2011). The second construct is impulsiveness, which represents consumer propensity for impulsive and unplanned purchasing. Impulsiveness was tested using two items from Ailawadi, Neslin, and Gedenk (2001). The third construct is price-consciousness, representing consumers’ perceptions of price and we used three items as defined by Ailawadi et al. (2001) to test for it. If panic buying is a price-independent hoarding behavior (Dholakia, 2020a), then this construct is expected to have a negative effect on such behavior. The fourth is conformity, which represents social relationships and is defined as how easily one’s choices depend on others. We borrowed two items from Mehrabian and Stefl (1995). The last construct is guilt, which expresses how much guilt consumers feel when they make a purchase that cannot be logically justified. We borrowed three items from Mishra and Mishra (2011) for guilt.

| Loading | Cronbach’s alpha | Composite reliability | AVE | ||

|---|---|---|---|---|---|

| Anxiety | I feel tense about the COVID-19 outbreak. | 0.888 | 0.866 | 0.870 | 0.692 |

| I feel anxious about the COVID-19 outbreak. | 0.810 | ||||

| I feel fearful about the COVID-19 outbreak. | 0.804 | ||||

| Impulsiveness | I often make an unplanned purchase when the urge strikes me. | 0.921 | 0.805 | 0.822 | 0.702 |

| I often find myself buying products on impulse in the grocery store. | 0.732 | ||||

| Price consciousness | I compare the prices of at least a few brands before I choose one. | 0.829 | 0.819 | 0.824 | 0.612 |

| I find myself checking the prices even for small items. | 0.787 | ||||

| It is important to get the best price for the products I buy. | 0.722 | ||||

| Conformity | I often rely and act upon the advice of others. | 0.814 | 0.764 | 0.764 | 0.618 |

| I tend to rely on others when I have to make an important decision quickly. | 0.760 | ||||

| Feelings of guilt | I feel guilty when I make impulse purchases | 0.796 | 0.727 | 0.734 | 0.512 |

| I regret when I make purchases that I am unable to logically justify. | 0.718 | ||||

| I feel guilty when considering luxurious products and services that are pleasurable but not necessary | 0.562 |

| Correlation matrix | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| 1. Anxiety | 0.832 | ||||

| 2. Impulsiveness | 0.074 | 0.838 | |||

| 3. Price consciousness | 0.267 | −0.242 | 0.783 | ||

| 4. Conformity | 0.161 | 0.298 | 0.121 | 0.786 | |

| 5. Feelings of guilt | 0.243 | −0.220 | 0.449 | 0.243 | 0.716 |

Note. Diagonal values of the correlation matrix represent the square root of average variance extracted (AVE) values. All other values represent the correlation coefficients.

Confirmatory factor analysis (Table 4) demonstrated that the goodness-of-fit index (GFI) = 0.976, comparative fit index (CFI) = 0.979, and the root mean squared error of approximation (RMSEA) = 0.043. Cronbach’s alpha values and composite reliability (CR) values are above the cut-off criterion of 0.7 (Bagozzi & Yi, 1988; Hair, Black, Babin, & Anderson, 2010). For convergent validity, average variance extracted (AVE) values of all constructs are greater than 0.5. For discriminant validity, evidence is present when the square root of the AVE for each construct exceeds the corresponding correlations between that and any other construct (Fornell & Larcker, 1981). Our results met this condition.

Demographics. We used the six demographics of gender, age, number of family members, number of children, household income (ten million yen), and education level. Gender is expressed as a dummy variable, where 1 represents male. Other demographics are expressed as continuous variables. The number of children is defined as the number of children under the age of 14 in a household. Education level is quantified by the number of years of education after elementary school.

Device Log Data from Television and Mobile Devices. Log data of television viewing and mobile usage were used in this study. The television data were automatically coded to identify which program each respondent watched at a certain time; we created television news and talk show variables to define their average daily usage (minutes). The mobile data were also automatically coded to identify which app each respondent used on their smartphones; we created social networking services (SNS), mobile news, e-commerce (EC), and healthcare variables to define average daily usage (minutes). These app categories were identified based on information from the Google Play Store. The observed period was from February 27 to April 14, 2020, corresponding to the period between the two policy interventions (from the declaration of the school closure to one week after the state of emergency). This period also corresponded to the period of the purchase variables. Table 5 shows the summary statistics of the samples.

| mean | sd | |

|---|---|---|

| Gender (male = 1) | 0.42 | 0.49 |

| Age | 47.96 | 11.82 |

| Number of family members | 2.83 | 1.22 |

| Number of children | 0.45 | 0.78 |

| Income | 0.61 | 0.28 |

| Education | 14.42 | 1.77 |

| SNS | 10.36 | 22.22 |

| Mobile news | 23.63 | 41.08 |

| EC | 3.70 | 10.02 |

| Healthcare | 0.86 | 3.16 |

| TV news | 37.84 | 39.33 |

| TV talk shows | 43.05 | 50.39 |

We used the Gaussian mixture model (McLachlan & Peel, 2000) to segment consumers using two indicators of consumer hoarding index, yi1 and yi2. The model can be expressed as follows:

| (2) |

After identifying the segments, we used a multinomial logit model to descriptively interpret the characteristics of the segments.

| (3) |

To determine the number of segments, we first estimated the model by varying the number of segments from one to seven. The EM algorithm used for the estimation is sensitive to the initial values of the parameters (Masyn, 2013). Thus, to reduce the likelihood of convergence to local maxima, we estimated the model with 50 random sets of starting parameters and adopted the minimum log-likelihood model as the best model for each number of segment models. Next, we calculated the Akaike Information Criterion (AIC), the Bayesian Information Criterion (BIC) (Schwarz, 1978) and the Consistent AIC (CAIC) (Bozdogan, 1987) as shown in Table 6. We obtained the minimum BIC and CAIC value for the five-segment model, while the AIC value was minimized in the six-segment model. Among the three criteria, the penalization is least strong in the AIC, stronger in the BIC, and strongest in the CAIC. It is known that there is a possibility that AIC overestimates the number of segments in a segmentation using a mixture model (Collins & Lanza, 2009). Therefore, we adopted the five-segment model as the best model based on the results supported by the two information criteria, BIC and CAIC.

| LL | AIC | BIC | CAIC | |

|---|---|---|---|---|

| 1-Segment | −2501.3 | 5012.5 | 5036.9 | 5041.9 |

| 2-Segment | −2395.4 | 4812.8 | 4866.5 | 4877.5 |

| 3-Segment | −2353.8 | 4741.6 | 4824.5 | 4841.5 |

| 4-Segment | −2317.0 | 4679.9 | 4792.0 | 4815.0 |

| 5-Segment | −2287.8 | 4633.6 | 4775.0 | 4804.0 |

| 6-Segment | −2274.1 | 4618.2 | 4788.9 | 4823.9 |

| 7-Segment | −2268.2 | 4618.3 | 4818.2 | 4859.2 |

Our segmentation results are clear and correspond to the magnitude of hoarding during the first and second waves. Table 7 shows the profile of purchasing for each segment. Table 8 details the demographics, psychographics, and media use variable coefficients, representing the impact of each variable on segment membership. Note that Segment 1 is the base segment, and the parameters are fixed at 0.

| Number of samples | Mean | Mean (a) | Mean (b) | a/b (%) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| n | % | yi1 | yi2 | qi1 | qi2 | 1st | 2nd | ||||

| 1 | Experienced shoppers | 379 | 39.2% | 0.216 | 0.145 | 3534 | 3166 | 2750 | 2646 | 129% | 120% |

| 2 | Inactive shoppers | 235 | 24.3% | −1.000 | −0.074 | 883 | 2540 | 2146 | 2065 | 41% | 123% |

| 3 | Weak panic buyers | 153 | 15.8% | 0.417 | −1.020 | 3484 | 919 | 2129 | 2184 | 164% | 42% |

| 4 | Rational shoppers | 145 | 15.0% | 0.530 | 0.945 | 3624 | 5060 | 2000 | 1944 | 181% | 260% |

| 5 | Strong panic buyers | 56 | 5.8% | 1.630 | 0.591 | 6197 | 2818 | 1228 | 1370 | 505% | 206% |

| Variables | Inactive shoppers | Weak panic buyers | Rational shoppers | Strong panic buyers | |||||

|---|---|---|---|---|---|---|---|---|---|

| coef. | s.e. | coef. | s.e. | coef. | s.e. | coef. | s.e. | ||

| Demographics | Constant | 1.789 | 0.845** | −0.506 | 1.003 | 1.104 | 0.990 | −4.514 | 1.586*** |

| Gender (male = 1) | 0.538 | 0.184*** | 0.380 | 0.212* | 0.345 | 0.218 | 1.430 | 0.325*** | |

| Age | −0.009 | 0.008 | 0.007 | 0.010 | −0.017 | 0.010* | 0.015 | 0.016 | |

| Number of family members | −0.271 | 0.097*** | −0.364 | 0.115*** | −0.217 | 0.117* | −0.052 | 0.170 | |

| Number of children | 0.044 | 0.152 | 0.231 | 0.178 | 0.254 | 0.167 | 0.564 | 0.241** | |

| Income | 0.386 | 0.332 | 0.348 | 0.386 | 0.645 | 0.393 | −0.195 | 0.591 | |

| Education | −0.114 | 0.050** | −0.023 | 0.059 | −0.093 | 0.059 | 0.065 | 0.090 | |

| Psychographics | Anxiety | 0.085 | 0.097 | 0.225 | 0.115* | 0.006 | 0.111 | 0.489 | 0.183*** |

| Impulsiveness | 0.029 | 0.096 | 0.200 | 0.110* | −0.228 | 0.109** | 0.456 | 0.173*** | |

| Price consciousness | 0.016 | 0.098 | 0.110 | 0.115 | 0.255 | 0.116** | 0.236 | 0.182 | |

| Conformity | −0.174 | 0.104* | −0.134 | 0.120 | −0.240 | 0.122** | −0.084 | 0.182 | |

| Feelings of guilt | 0.081 | 0.103 | 0.203 | 0.121* | −0.094 | 0.116 | −0.065 | 0.179 | |

| Media use | SNS | 0.008 | 0.004** | 0.006 | 0.005 | −0.006 | 0.006 | 0.007 | 0.007 |

| Mobile news | 0.001 | 0.002 | 0.000 | 0.003 | 0.005 | 0.002** | 0.007 | 0.003** | |

| EC | −0.013 | 0.010 | −0.010 | 0.010 | −0.009 | 0.011 | −0.053 | 0.031* | |

| Healthcare | −0.013 | 0.028 | 0.007 | 0.028 | −0.016 | 0.034 | −0.030 | 0.055 | |

| TV news | 0.001 | 0.003 | 0.000 | 0.003 | −0.001 | 0.003 | 0.000 | 0.004 | |

| TV talk shows | 0.000 | 0.002 | 0.001 | 0.002 | 0.001 | 0.002 | −0.001 | 0.004 | |

Note. *** p < .01, ** p < .05, * p < .10.

Segment 1, which has the highest composition ratio (39.2%), includes typical household shoppers who often purchase daily consumer goods. Because the mean values of

It is important to note that these consumers only stockpiled small amounts within the bounds of common sense. This study suggests that panic buying is not common behavior for consumers who purchase many consumer packaged goods on a daily basis. As an additional validation, we calculated purchase increases by category in Appendix Tables B.1 and B.2. In both the first and second waves, purchases of hygiene products (such as wet tissues, hand skin care, paper towels, and facial tissues) and staple foods (such as flour, spaghetti, pre-mixed flour and pack instant noodle) increased. However, even in the categories with the largest increases, the increase rates were only 1.5 to 2.5 times higher than usual. Hence, this result also shows that experienced shoppers stockpiled within a sensible range.

In contrast, panic buyers are included in Segment 5 which has the smallest composition (5.8%) and the smallest average purchase amounts

(

Another segment with panic buyers is segment 3 (15.8%). Consumers in this segment hoarded in the first wave but not in the second. Segment 3 has marginally positive and significant coefficients (p < .10) for anxiety and impulsiveness. The traits of anxiety, impulsiveness, and more male are similar to strong panic buyers. Thus, we consider these consumers to be weak panic buyers. Besides this, weak panic buyers tended to have smaller families and feel guilty for unnecessary consumption. Members in this segment purchased typical panic buying products (such as hygiene products and staple foods) during the first wave. However, from the second wave onwards, they refrained from purchasing these products due to guilt over unnecessary consumption.

Consumers in segment 2 (24.3%) did not shop much during the first wave and only shopped a little more during the second wave. Since conformity is marginally negative and significant (p < .10), it is inferred that they are only slightly affected by the actions of those around them.

Segment 4 consumers, who hoarded more in the second wave, have following characteristics; they tended to be younger, have smaller families, watched more mobile news, and demonstrated higher price consciousness, lower conformity, and lower impulsiveness. Panic buyers are likely to buy indiscriminately based on availability rather than price (Dholakia, 2020a), while panic buying is also induced by the behavior of others. Since the consumers in Segment 4 have the opposite tendency, they are more likely to hoard for other rational reasons. For example, their purchases are characterized by hoarding staple foods, seasonings, and alcohol, according to Table B.2. This segment includes a large number of young households, therefore, it is possible that their consumption increased due to their children’s schools closing.

This study conducted consumer segmentation to understand panic buying behavior during the COVID-19 outbreak. Panic buying is a consumer behavior caused by negative emotions and social influences. The classical theory of consumer behavior does not necessarily apply to this panic buying; therefore, this field represents a niche area of consumer behavior research (Dholakia, 2020b; Yuen et al., 2020). However, panic buying is a common phenomenon that is often seen after disasters, and there has been a worldwide increase in research related to panic buying after the COVID-19 pandemic. Understanding the mechanism of panic buying has many important implications, including maintaining people’s health during such disasters, informing government policymaking, and ensuring a stable supply of goods for the retail industry. In this context, this study attempted to understand the phenomenon using an integrated data approach that included actual purchase behavioral data and psychographics. Its novelty is that it demonstrates the distinction between the behavioral and psychological aspects of panic buyers.

The study analyzed how panic buying occurs over time and showed that two temporary purchase increases occurred in the Japanese consumer packaged goods market between February and April 2020. These temporary purchase increases were associated with the timing of two government interventions related to the severity of COVID-19. The panic buyers identified in this study were found to substantially hoard in both the first and second waves. They hoarded large amounts of especially hygiene products, between 7 and 22 times more than usual. Using psychographics related to these consumers, this study reveals that panic buyers have stronger anxiety of COVID-19 and impulsiveness for unplanned purchases. We also indicate that panic buyers tend to be more male who do not usually purchase many consumer goods. However, our results suggest panic buying is not a common behavior that many consumers engage in. The evidence in Japan indicates that consumers with more purchasing experience, including female with larger families do not panic buy and only stockpile a little more than usual. The results on individual purchasing experiences are unique to this study, which used panel data, whereas many previous studies on panic buying were based on surveys.

This study presents managerial implications for the management of consumer anxiety related to panic buying. Consumers are more likely to engage in anxiety-driven panic buying in response to policy interventions in the immediate aftermath of a disaster; however, subsequent hoarding may occur in association with policy interventions but is not necessarily accompanied by anxiety, and consumers may have learned from previous experiences. In this context, policymakers must be especially cautious in their initial responses to a disaster: it is important to implement measures that do not cause excessive anxiety among consumers. Another perspective to note is that the percentage of panic buyers is not particularly high; therefore, curbing their panic buying will enable the rest to continue to shop. Limiting the amount that can be purchased by one person is an effective operation for retailers to prevent supply shortages.

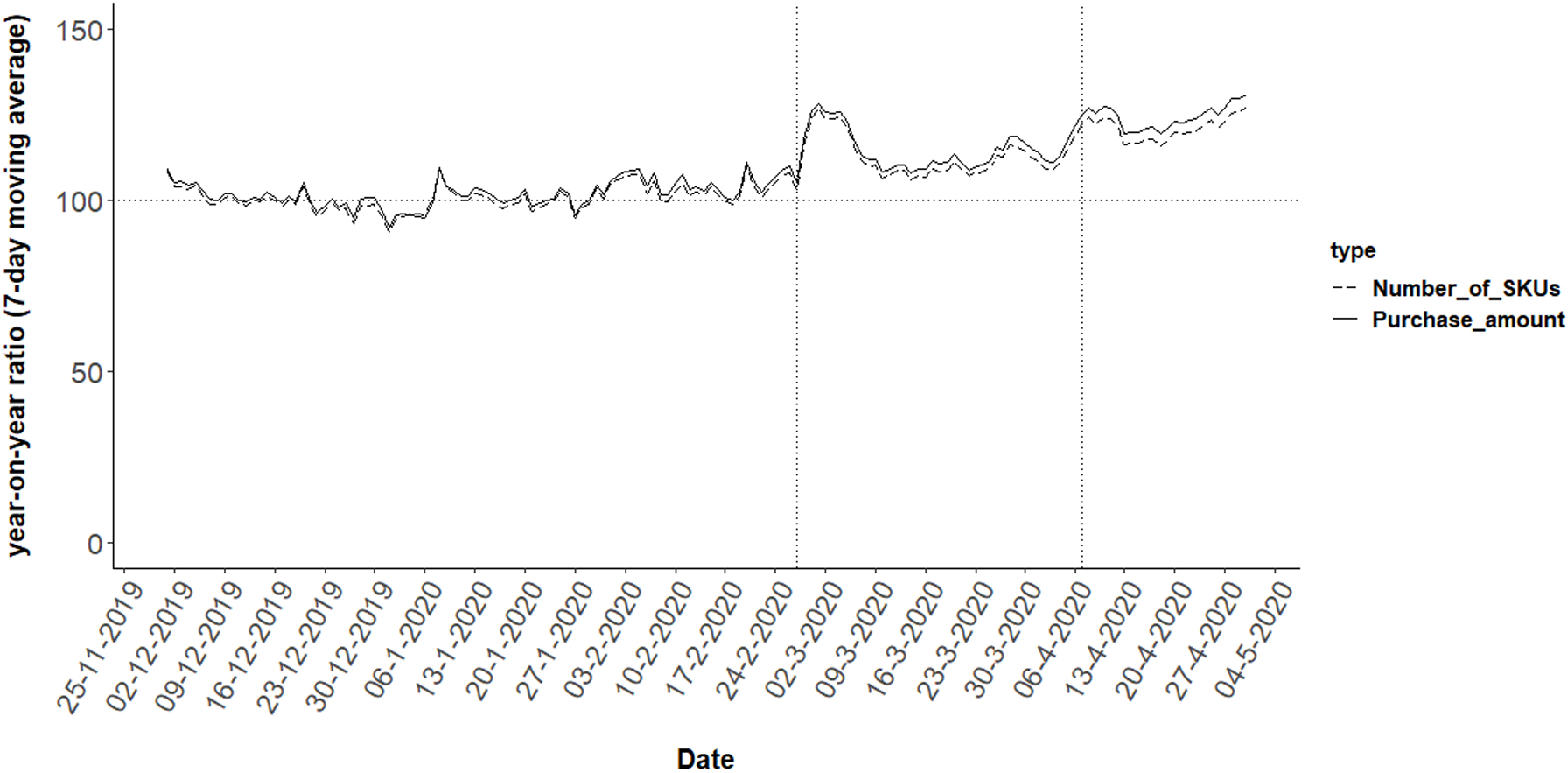

Finally, this study has some limitations that present opportunities for future research. First, our analysis is based on purchase amounts, and we do not refer to the price changes of each product. The reason for this is that precise quantity information is not available for some categories in our data set. For instance, products could be sold individually or in bulk, but the number of units adjusted for size is not documented. For example, with respect to SKUs of toilet paper, we cannot easily distinguish whether it is a pack of 8 or a pack of 12 just from the data we have. Thus, it is difficult to capture SKUs qualitatively and decompose purchase amount into price and quantity in multiple categories. If this problem is solved in future, we would attempt to analyze the relationship of prices and quantities. We do, however, have some support for the fact that the increase in purchase amount is largely the result of an increase in purchase quantity and not due to price increases. Under the assumption that the quality of SKUs is not distinguished, we can show this. Appendix Figure C shows the time series of the year-on-year ratio (7-day moving average) of the number of SKUs purchased, using the same calculation as the purchase amount in Figure 2. From this figure, we can see that the variation in the purchase amount and the number of SKUs purchased are similar.

Second, we did not find a strong relationship between the segment of panic buying and media usage, especially television viewing. A reason may be that we manipulated the media usage variable as consumers’ general habits, rather than media contact related to COVID-19. Although there are limitations to the data used in this study, if we could identify associations between television programs and mobile apps and COVID-19, we could extract more influential data on media usage behavior.

The authors thank the editors and anonymous reviewers for their helpful and constructive suggestions. The authors are also grateful to INTAGE Inc. for providing the data. This research was supported by Japan Society for the Promotion of Science, KAKENHI (19K01947; 19K13835; 21H00759; 22K20145).

| First Wave | ||||||||

|---|---|---|---|---|---|---|---|---|

| No | Product Category | h | d | No | Product Category | h | d | |

| 1 | household gloves | 199.5 | 107.2 | 31 | insecticide | 42.8 | 44.1 | |

| 2 | sanitary napkins | 157.8 | 118.6 | 32 | wrapping film | 42.6 | 22.8 | |

| 3 | paper towels | 157.7 | 103.2 | 33 | barley tea | 41.9 | 30.3 | |

| 4 | wet tissues | 153.0 | 116.1 | 34 | kitchen drain bags | 41.9 | 22.4 | |

| 5 | facial tissues | 111.1 | 95.5 | 35 | food extracts | 40.9 | 17.4 | |

| 6 | toilet paper | 109.8 | 74.3 | 36 | pet care products | 40.7 | 32.1 | |

| 7 | dried noodles | 104.7 | 58.4 | 37 | stew | 40.7 | 23.8 | |

| 8 | pre-cooked rice | 92.9 | 56.0 | 38 | cooking rice wine | 40.1 | 19.3 | |

| 9 | spaghetti | 92.8 | 51.9 | 39 | canned vegetables | 38.3 | 19.0 | |

| 10 | other household cl. | 90.3 | 58.8 | 40 | salt | 37.4 | 29.2 | |

| 11 | disposable cl. paper | 83.5 | 46.9 | 41 | frozen fruit/veges | 33.7 | 16.3 | |

| 12 | instant noodle packs | 81.7 | 51.7 | 42 | hand and skincare | 32.9 | 16.4 | |

| 13 | pre-mixed flour | 79.2 | 31.5 | 43 | breadcrumbs | 31.4 | 17.6 | |

| 14 | air freshener | 76.4 | 51.8 | 44 | toilet-bowl cleaner | 31.2 | 14.3 | |

| 15 | pasta sauce | 75.7 | 43.6 | 45 | ketchup | 31.0 | 14.8 | |

| 16 | soap | 69.0 | 38.4 | 46 | instant soup | 30.7 | 18.8 | |

| 17 | flour | 63.4 | 27.9 | 47 | mayonnaise | 30.5 | 20.4 | |

| 18 | curry | 56.6 | 36.7 | 48 | tomato juice | 30.1 | 22.6 | |

| 19 | laundry bleach | 53.4 | 29.6 | 49 | health food | 29.5 | 23.9 | |

| 20 | cup instant noodles | 52.7 | 36.0 | 50 | heavy detergent | 29.0 | 20.1 | |

| 21 | ochazuke topping | 48.3 | 34.4 | 51 | frozen prepared food | 29.0 | 16.1 | |

| 22 | aluminum foil | 48.0 | 24.7 | 52 | bath cleaner | 27.5 | 15.2 | |

| 23 | rice | 47.6 | 30.3 | |||||

| 24 | other sundries | 47.6 | 62.7 | |||||

| 25 | canned seafood | 46.5 | 19.7 | |||||

| 26 | canned fruit | 45.9 | 23.6 | |||||

| 27 | food packages | 44.3 | 17.3 | |||||

| 28 | dishwashing liquid | 44.2 | 24.8 | |||||

| 29 | macaroni | 43.5 | 18.8 | |||||

| 30 | rice seasoning mix | 43.4 | 26.9 | |||||

Note: This table is sorted in descending order for h-values.

| Second Wave | ||||||||

|---|---|---|---|---|---|---|---|---|

| No | Product Category | h | d | No | Product Category | h | d | |

| 1 | household gloves | 131.6 | 30.5 | 31 | rice | 42.3 | 25.0 | |

| 2 | food extracts | 121.1 | 37.4 | 32 | wrapping film | 41.9 | 20.8 | |

| 3 | pre-mixed flour | 116.0 | 24.1 | 33 | whisky | 41.4 | 18.1 | |

| 4 | spaghetti | 113.8 | 41.7 | 34 | hand and skin care | 41.1 | 9.2 | |

| 5 | whipped cream | 113.2 | 20.9 | 35 | beauty and health drinks | 40.6 | 35.3 | |

| 6 | dried noodles | 105.3 | 44.1 | 36 | dishwashing liquid | 39.0 | 5.7 | |

| 7 | flour | 96.7 | 8.3 | 37 | other all-purps seasoning | 38.8 | 12.4 | |

| 8 | air freshener | 90.2 | 36.9 | 38 | toilet paper | 38.7 | 26.4 | |

| 9 | pasta sauce | 81.9 | 30.7 | 39 | bath cleaner | 37.2 | 21.9 | |

| 10 | soap | 75.6 | 10.4 | 40 | soy sauce | 37.0 | 9.4 | |

| 11 | instant noodle packs | 72.0 | 24.8 | 41 | pouch-packed food | 36.8 | 13.4 | |

| 12 | macaroni | 68.8 | 15.9 | 42 | toilet-bowl cleaner | 35.9 | 11.6 | |

| 13 | other household cl. | 63.8 | 25.0 | 43 | seasoning soy sauce | 35.8 | 10.0 | |

| 14 | pre-cooked rice | 63.6 | 28.2 | 44 | kitchen drain bags | 34.4 | 10.8 | |

| 15 | paper towels | 61.2 | 14.4 | 45 | other food products | 34.2 | 7.8 | |

| 16 | sweet rice wine | 59.6 | 22.3 | 46 | cooking/tempura oil | 34.1 | 11.6 | |

| 17 | aluminum foil | 58.4 | 24.5 | 47 | other sundries | 33.8 | 21.3 | |

| 18 | disposable cl. paper | 54.2 | 15.9 | 48 | ponzu sauce | 33.4 | 11.1 | |

| 19 | canned seafood | 53.1 | 13.2 | 49 | instant soup | 33.1 | 10.0 | |

| 20 | food packages | 52.7 | 11.1 | 50 | hair color | 32.5 | 21.7 | |

| 21 | laundry bleach | 52.6 | 24.9 | 51 | kitchen brushes/sponges | 32.4 | 13.5 | |

| 22 | sesame oil | 50.9 | 6.2 | 52 | seaweed | 30.9 | 7.9 | |

| 23 | wet tissues | 49.1 | 14.6 | 53 | dried fish flakes | 30.7 | 6.8 | |

| 24 | starch noodle | 48.1 | 12.4 | 54 | soda | 30.4 | 19.8 | |

| 25 | canned vegetables | 47.7 | 15.1 | 55 | cup instant noodles | 30.0 | 13.6 | |

| 26 | rice seasoning mix | 47.0 | 18.4 | 56 | miso paste | 29.9 | 7.5 | |

| 27 | curry | 46.8 | 20.6 | 57 | frozen seafood | 28.5 | 6.8 | |

| 28 | breadcrumbs | 44.3 | 7.2 | 58 | regular coffee | 28.4 | 13.5 | |

| 29 | powdered stock | 43.4 | 16.2 | 59 | miso/suimono soup | 27.8 | 16.2 | |

| 30 | ochazuke topping | 43.1 | 19.1 | 60 | food seasoning mix | 26.9 | 6.2 | |

| 61 | hair rinse | 26.5 | 19.6 | |||||

| 62 | cat food | 26.4 | 16.5 | |||||

| 63 | wine | 26.0 | 8.1 | |||||

Note: This table is sorted in descending order for h-values.

| Experienced Shoppers | Inactive shoppers | Weak panic buyers | ||||

|---|---|---|---|---|---|---|

| No | First Wave | |||||

| 1 | wet tissues | 241% | canned fruit | 120% | pre-cooked rice | 259% |

| 2 | flour | 224% | paper towel | 114% | cooking rice wine | 253% |

| 3 | hand and skin care | 216% | wet tissues | 109% | household glove | 250% |

| 4 | rice seasoning mix | 191% | pasta sauce | 96% | spaghetti | 247% |

| 5 | pet care product | 177% | rice seasoning mix | 95% | facial tissue | 244% |

| 6 | sanitary napkin | 172% | ketchup | 94% | kitchen drain bag | 220% |

| 7 | paper towel | 171% | pack instant noodle | 91% | laundry bleach | 219% |

| 8 | pack instant noodle | 165% | toilet-bowl cleaner | 82% | pet care product | 214% |

| 9 | food extracts | 165% | pre-mixed flour | 82% | paper towel | 211% |

| 10 | facial tissue | 165% | macaroni | 81% | pre-mixed flour | 194% |

| 11 | pre-mixed flour | 160% | mayonnaise | 80% | dish wash | 193% |

| 12 | other sundries | 157% | flour | 77% | soap | 190% |

| 13 | instant soup | 155% | frozen fruit/vege | 75% | pack instant noodle | 188% |

| 14 | food package | 153% | pre-cooked rice | 74% | curry | 183% |

| 15 | aluminum foil | 144% | bath cleaner | 70% | other sundries | 182% |

| 16 | curry | 142% | salt | 61% | instant soup | 182% |

| 17 | spaghetti | 142% | facial tissue | 61% | canned seafood | 181% |

| 18 | cooking rice wine | 141% | stew | 57% | bath cleaner | 175% |

| 19 | wrapping film | 140% | instant soup | 56% | toilet paper | 174% |

| 20 | soap | 138% | frozen prepared food | 54% | frozen fruit/vege | 171% |

| No | Second Wave | |||||

| 1 | flour | 227% | pouch-packed food | 290% | other food products | 113% |

| 2 | wet tissues | 193% | other sundries | 226% | sesame oil | 97% |

| 3 | hand and skin care | 192% | pre-mixed flour | 215% | starch noodle | 97% |

| 4 | spaghetti | 181% | flour | 188% | macaroni | 95% |

| 5 | powdered stock | 174% | sweet rice wine | 186% | seaweed | 90% |

| 6 | pouch-packed food | 170% | food package | 182% | paper towel | 87% |

| 7 | paper towel | 166% | cooking/tempura oil | 176% | miso paste | 84% |

| 8 | pre-mixed flour | 156% | disposable cl. paper | 161% | food seasoning mix | 82% |

| 9 | pack instant noodle | 154% | spaghetti | 159% | food extracts | 78% |

| 10 | macaroni | 147% | wet tissues | 158% | curry | 77% |

| 11 | aluminum foil | 143% | cat food | 158% | pre-mixed flour | 75% |

| 12 | ochazuke topping | 140% | bath cleaner | 157% | bread crumb | 74% |

| 13 | other all-purps seasoning | 138% | laundry bleach | 155% | canned seafood | 69% |

| 14 | household glove | 138% | sesame oil | 155% | soda | 68% |

| 15 | curry | 138% | other all-purps seasoning | 153% | dried fish flakes | 68% |

| 16 | pasta sauce | 138% | pasta sauce | 149% | toilet-bowl cleaner | 68% |

| 17 | canned vegetable | 137% | regular coffee | 147% | rice seasoning mix | 67% |

| 18 | dish wash | 137% | soap | 144% | miso/suimono soup | 67% |

| 19 | soy sauce | 133% | rice seasoning mix | 142% | pack instant noodle | 66% |

| 20 | Soda | 132% | ponzu sauce | 138% | household glove | 65% |

Note: As an additional analysis, in this Table, we calculated the means of qi1, qi2,

| Rational shoppers | Strong panic buyers | |||

|---|---|---|---|---|

| No | ||||

| 1 | household glove | 364% | wet tissues | 2218% |

| 2 | pre-mixed flour | 333% | household glove | 1801% |

| 3 | paper towel | 288% | health food | 1510% |

| 4 | pasta sauce | 284% | pet care product | 1248% |

| 5 | facial tissue | 276% | hand and skin care | 915% |

| 6 | sanitary napkin | 265% | rice seasoning mix | 745% |

| 7 | pack instant noodle | 249% | facial tissue | 734% |

| 8 | spaghetti | 245% | toilet paper | 720% |

| 9 | disposable cl. paper | 225% | canned fruit | 706% |

| 10 | rice seasoning mix | 224% | rice | 677% |

| 11 | other house hold cl. | 219% | pre-cooked rice | 671% |

| 12 | mayonnaise | 218% | toilet-bowl cleaner | 667% |

| 13 | rice | 216% | air freshener | 593% |

| 14 | curry | 212% | barley tea | 546% |

| 15 | other sundries | 210% | spaghetti | 540% |

| 16 | food package | 207% | sanitary napkin | 529% |

| 17 | frozen fruit/vege | 207% | heavy detergent | 470% |

| 18 | ketchup | 200% | pack instant noodle | 440% |

| 19 | heavy detergent | 193% | canned seafood | 429% |

| 20 | canned seafood | 191% | macaroni | 417% |

| No | ||||

| 1 | beauty healthy drink | 372% | household glove | 3310% |

| 2 | paper towel | 371% | wet tissues | 1053% |

| 3 | dried noodle | 368% | food extracts | 756% |

| 4 | soap | 358% | other house hold cl. | 629% |

| 5 | food extracts | 356% | food package | 523% |

| 6 | rice | 347% | soap | 522% |

| 7 | spaghetti | 345% | aluminum foil | 442% |

| 8 | hand and skin care | 342% | spaghetti | 394% |

| 9 | other all-purps seasoning | 340% | pre-mixed flour | 354% |

| 10 | whisky | 338% | other sundries | 349% |

| 11 | other house hold cl. | 332% | sweet rice wine | 346% |

| 12 | cat food | 332% | regular coffee | 341% |

| 13 | pre-mixed flour | 320% | seaweed | 339% |

| 14 | ochazuke topping | 307% | pack instant noodle | 318% |

| 15 | air freshener | 305% | toilet paper | 317% |

| 16 | food package | 304% | canned seafood | 295% |

| 17 | powdered stock | 302% | hair rinse | 290% |

| 18 | canned vegetable | 300% | hand and skin care | 287% |

| 19 | toilet-bowl cleaner | 298% | flour | 283% |

| 20 | dish wash | 283% | frozen seafood | 275% |

Note: As an additional analysis, in this Table, we calculated the means of qi1, qi2,

Time series of the year-on-year ratio comparing number of SKUs and purchase amount.