2019 Volume 44 Issue 3 Pages 141-147

2019 Volume 44 Issue 3 Pages 141-147

With the world’s human population expected to reach nearly 10 billion by 2050 and the negative impact of climate change on agriculture, maintenance of a stable global food supply is under significant threat. Given these dynamics, this article outlines the current market trends in the crop protection industry, including corporate consolidations and agrochemical regulations, comments on new technologies and the situation surrounding research and development (R&D) in the industry. It also highlights how agrochemicals contribute to building a more sustainable society.

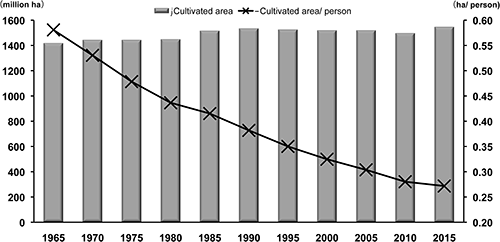

1. Environmental trends (population growth, grain demand, and climate change)According to an estimate by the Food and Agriculture Organization (FAO), the world population has reached 7.55 billion in 2017 and will reach 9.8 billion by 2050. Accompanying this growth is a demand for grain that is expected to increase at least 2.2-fold from 1970 to 2020 (2.5 billion tons). In contrast to needed increases in grain demand to parallel population growth, the amount of cultivated area in the world in 2015 was virtually the same as it was in 1965, with no rapid increase expected in the future. Therefore, combined with the predicted population growth, it appears that cultivated area per person will continue to decline worldwide.

Climate change is also looming as a major threat to grain production. On the one hand, temperatures rise could extend the growing season in certain areas, and it is possible that increased carbon dioxide levels may facilitate photosynthetic carbon dioxide fixation in certain types of plants, potentially leading to increases in grain productivity. Especially in areas in the Eurasian continent and high-latitude regions of North America, increased temperatures are expected to enhance grain crop yields. Many other areas, however, are likely to witness lower grain crop yields due to the influence of climate change. Moreover, many of the areas predicted to suffer reduced crop yields are currently major grain-producing regions. This means climate change threatens to greatly affect crop production as a whole. Across the world, the loss of yield in 2050 compared to 2000 is expected to be 24% for maize, 11% for rice, and 3% for wheat.1)

Consequently, it is obvious that it will not be possible to maintain the balance of supply and demand of grain down the road at current rates of grain production. In addition to the negative effects of climate change, it is unreasonable to expect a rapid expansion of cultivated area synchronously with the increasing demand for grain production that results from population growth. Under such environmental conditions, agricultural productivity per unit cultivated area must be increased to provide sufficient food to support the world’s population. Furthermore, it is imperative to use agricultural materials, including agrochemicals, more effectively than ever before and adopt innovative technological approaches to overcome these problems.

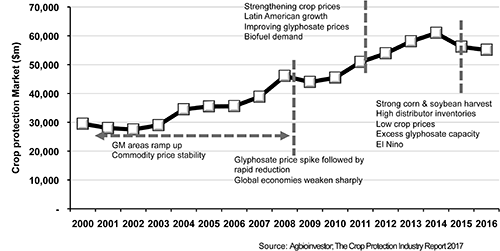

2. Market trends (agrochemicals, GM seeds)As a whole, the market for agrochemical pesticides has grown steadily since 2006. Most recently, although the market displayed a downward trend from 2014 to 2016,2) it is widely predicted that it will recover from 2018 onwards to return to a path of growth.

Meanwhile, when looking at the crop protection market on a region by region basis, the overall trend line has been shrinking in the last two or three years, although many see this as a temporary phenomenon.

A notable bright spot has been Latin America which has grown remarkably since 2010.3)

One characteristic of recent crop protection markets is the expansion of the generic products,4) which contrasts with declining sales for agrochemicals that have been newly discovered through R&D activities and then patented. Reflecting this situation, several companies selling generic products have established themselves as those regularly ranked high on the list of top sellers of agrochemical products.

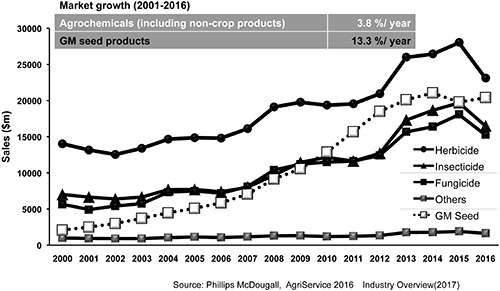

Recently, in addition to developing and selling agricultural chemicals, major agrochemical companies have focused on genetically modified (GM) seeds, and this newer sector has grown to account for a considerable proportion of their total sales.

While the crop protection market displayed a growth rate of 3.8% from 2001 to 2016, the market for GM seeds developed and sold by major agrochemical companies achieved a growth rate of 13.3%, around three times higher than that of the crop protection market.3) Furthermore, the absolute sales of GM seeds reached approximately 20.4 billion US dollars in 2016,5) a figure comparable to the sales of herbicides, which generated the highest revenue among chemical pesticides, arousing great optimism for further expansion of the GM seeds sector.

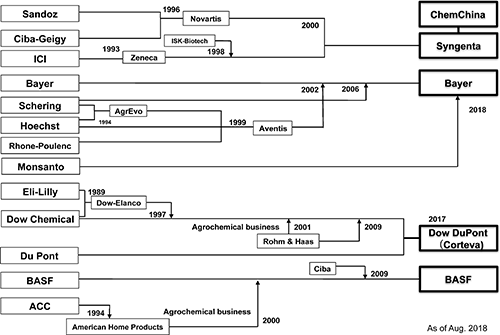

As mentioned above, even though the crop protection market has grown significantly, leading agrochemical companies have entered a period of significant consolidation. There were more than ten major agrochemical companies in the United States (US) and Europe in 1990, but the number of these business entities dropped to six majors by 2009 through mergers and acquisitions (M&A), namely Syngenta, Bayer, BASF, Dow Chemical, DuPont and Monsanto. These six companies subsequently reorganized in response to poor business performance, the surge of R&D expenses due to tighter regulations on new agrochemical registration, expectations from stock holders for the realization of a new growth strategy and other factors. Most recently, through further consolidation activities, the six majors are now down to Bayer, DowDuPont (now Corteva), BASF, and Syngenta, which is now under the umbrella of the China National Chemical Corporation (commonly known as ChemChina). In 2017, FMC Corporation acquired a sizable portion of DuPont’s crop protection business and R&D assets that DuPont had divested upon a merger with Dow Chemical. As such, the crop protection market has entered an age of five major players; that is, the abovementioned four companies plus FMC Corporation.

From here, we examine the situation of agrochemical R&D and the impetus behind the corporate reorganization and consolidation from several perspectives. The first involves reaffirming the contribution of agrochemicals to agricultural production. According to an article5) written in 2006, maximum achievable yields in rice, wheat, maize and soybean may decrease by ca. 20–50% without the proper use of agrochemicals. On the other hand, using agrochemicals can recover the yield by up to 60–70%. Thus, it is clear that the current level of crop production is attainable only with appropriate use of agrochemicals, without which the crop yield would drop dramatically. The same article also explains that more effective use of agrochemicals could lead to a further increase in crop yield, creating expectations for further technical improvement.

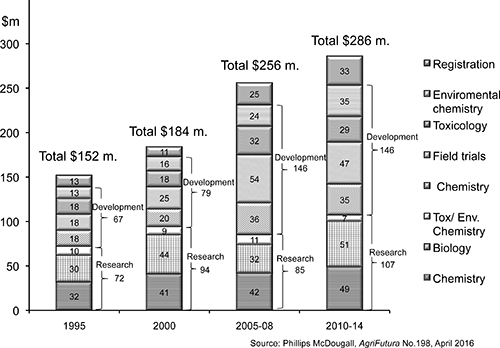

While agrochemicals have been making a huge contribution toward the enhancement of crop productivity as just described, it is becoming ever more difficult to develop agrochemicals. It takes over ten years and R&D expenditure of $100–350 million to develop and market a new agrochemical, and the process involves: discovering a new agrochemical candidate; conducting safety studies, biological studies, and formulation research in parallel; comprehensively evaluating the results from these studies; and finally applying for and obtaining registration as an agrochemical. Moreover, because of various factors mentioned later, currently the probability of obtaining a new agrochemical is estimated as one in around 160 thousand compounds. As such, each company developing agrochemicals has to invest 7–10% of its sales in R&D activities every year. What is more, the cost and time required to develop agrochemicals have been increasing each year. For example, in 1995, the development expense was 152 million dollars and R&D time was 8.3 years; however, according to a survey conducted from 2010 to 2014, these same metrics increased to 286 million dollars and 11.3 years, respectively,6) suggesting that such a hike in the R&D burdens is one of the factors driving consolidation of companies involved in agrochemical R&D as mentioned above. Furthermore, “development” costs are rising quickly for environmental and toxicity studies, and field trials, which are conducted in the latter stages of development.7) The impetuses behind these cost increases are a growing demand for safer agrochemicals and tightening regulations by relevant authorities. As if reflecting recent difficulties in agrochemical R&D activities, the number of new agrochemicals launched into the market peaked in the 1990s and has declined since the 2000s,7) illustrating the harsh conditions for new agrochemical development.

Nevertheless, even in this difficult environment for agrochemical R&D, research activities at Japanese agrochemical companies remain relatively strong. Although sales by the Japanese companies are smaller than those by the major players in the US and Europe, ten Japanese companies have ranked within the top twenty with the highest numbers of newly marketed products (from 1980 to 2016).7) During the same period, among the 363 newly marketed agrochemicals worldwide, 114 (31%) were developed by Japanese companies. Even in the ever tougher environment for R&D, for example, in 2016, Japanese companies accounted for approximately 40% of the later R&D stage agricultural chemicals.7) Thus, it is safe to conclude that the R&D capability of Japanese companies to launch new chemicals is very high and comparable to that of the leading companies in the US and Europe.

The application rates of agrochemicals, which require a lot of time and effort to market, were ca. 2,400 g of active ingredient per hectare (gai/ha) for herbicide, ca. 1,700 gai/ha for insecticide, and ca. 1,200 gai/ha for fungicide in the 1950s. By the 2000s, however, these application rates declined to 60–180 gai/ha,8) clearly demonstrating the superior performance (increased activity) of active ingredients in newly developed agrochemicals. Safety was another beneficiary; around 1960 in Japan, about the half of the agrochemicals were categorized as Specified Poisonous Substances or Poisonous Substances. However, by 2014, the number of such agrochemicals decreased sharply and nowadays nearly 90% of agrochemicals are categorized as Ordinary Substances.9)

Furthermore, many biological pesticides are currently under development that are supposed to have less impact on the environment and a better safety profile (a biological pesticide is defined as a pesticide whose active ingredients are derived from living organisms. In a narrower sense, this includes only living things themselves, such as natural-enemy insects, while in a broader sense, the definition can also include substances extracted from microorganisms and the like. This paper adopts the broader definition). A review of new crop protection products marketed by year revealed that the number of chemical pesticides gradually began to decline from the 1990s, whereas the number of biological pesticides started to increase from the 1980s and averaged approximately ten new biological pesticides have entered the market per annum from the 1990s to the present.8) It is noteworthy, however, that the market size for biological pesticides is still relatively small, accounting for 5.6% of the whole crop protection market in 2016, revealing that sales of individual products are only modest.

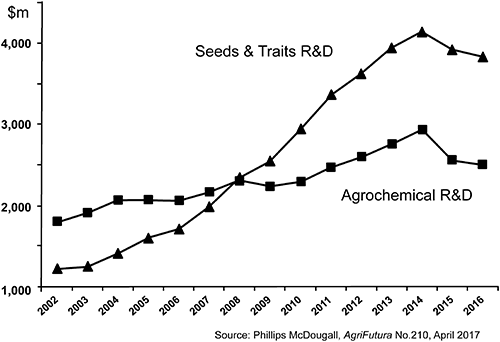

Meanwhile, major agrochemical companies have developed a sales strategy of selling GM seeds in combination with agrochemicals since 1990s, taking a direction other than improving safety as mentioned above. These big agrochemical companies acquired seed companies and comprehensively expanded their crop protection business by developing and selling GM seed products. As of 2016, according to a report published by Phillips McDougall, the percentages of seed business in the total sales of the former six major players were as follows: 21% at Syngenta, 14% at Bayer, 70% at DuPont, 25% at Dow, and 75% at Monsanto.10) Moreover, along with increasing sales of seed products, their R&D costs have also been rising sharply. For instance, the sum of R&D expenditure at the former six major companies was approximately 1.2 billion dollars in 2002, and this figure rose steadily to reach 2.2 billion dollars by 2008—about the same as the R&D expenditure for chemical pesticides. By 2014, the number had hit 4 billion dollars, equivalent to ca. 1.5 times of that for chemical pesticides.11) These changes in R&D expenditure may indicate the direction of the major agrochemical companies toward further expanding the seed business sector. Moreover, linked to the increase in R&D expenditure for seed products is the upward trend in the number of major seed products brought to market each year,12) suggesting further growth of the seed business.

While the leading agrochemical companies abroad have been working toward diversifying their businesses to include seed products, Japanese agrochemical companies have not yet entered the GM crop seed sector due to R&D costs and issues related to public acceptance and the like. Instead, companies in Japan are trying to strategically develop their own unique businesses in the area where they can generate synergy through combining seed business of the major companies with chemical pesticides provided by Japanese companies. For example, there is a case in which a quick solution was offered to combat herbicide-resistant weeds which grew during cultivation of herbicide-resistant GM crops that were developed and sold by major agrochemical companies and cultivated under non-selective herbicide. These resistant weeds were successfully eliminated by applying selective herbicides such as flumioxazin and pyroxasulfone. More specifically, in the weed control system for Roundup Ready® soybeans, once Roundup-resistant weeds had grown in the field, Roundup-resistant weeds, in addition to Roundup Ready® soybeans, would remain in the field even after application of Roundup. However, if herbicides to which soybeans are not sensitive are applied before the soybeans sprout in such field, it is possible to eliminate Roundup-resistant weeds. This type of practice is now regarded as an essential technical system for fields where resistant weeds have grown. In this way, even though they do not participate in the seed business, there are opportunities for Japanese agrochemical companies to collaborate with the major US and European companies through strategic technical responses such as proposing complementary technologies.

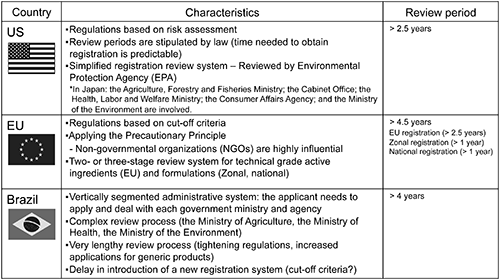

One factor mentioned so far that can strongly influence industry trends is a regulatory issue associated with agrochemical registration. As was widely known, regulations governing agrochemicals in many regions, including the US and European countries, have become more restrictive with each passing year. Especially in the European Union (EU), the criteria for safety and environmental impact assessment were switched from risk-based to hazard-based in 2011, and the number of registered chemical products has been declining due to so-called cut-off criteria. In particular, the honey-bee Colony Collapse Disorder problem had evoked strong political action, and eventually outdoor use of three types of neonicotinoid insecticides were totally banned. Also, the system under which both technical grade and formulations are evaluated in two or three stages in each division level (i.e., EU, zonal, and country) contributes to prolonging the period required for registration. Similarly, in Brazil, where the crop protection market is expanding, a lengthy review process is required due to its vertically segmented administrative system. Brazil also envisages employing the cut-off criteria. Meanwhile, in Japan, the amendment of the Agricultural Chemical Regulation Law was implemented in December 2018, and the decision was made to introduce a re-evaluation system as well as a new risk assessment system for several terrestrial and aquatic organisms and for worker exposure. As seen above, the hurdles have been raised higher and higher every year to initially register and then re-register the active ingredients of agrochemicals. Coupled with that, the development costs for agrochemicals keep rising as previously mentioned, which can be one of the driving factors for the recent spike in M&A deals among major agrochemical companies in US and Europe.

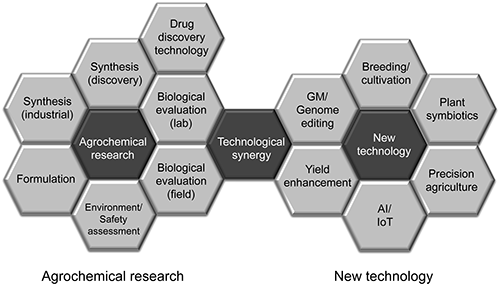

As stated above, since the 1990s the major agrochemical companies in the US and Europe have been adding the seed business sector to their conventional chemical pesticide business. Recently, however, they started exploring new fields as well as accelerating the development process by introducing novel technologies aiming to further improve agricultural productivity. While technologies that have supported development of conventional chemical pesticides to date include chemical synthesis, biological evaluation, formulation, and safety and environmental-impact assessment, the addition of GM seed technology represents applications of new technologies with the goal of accelerating the R&D process and broadening their scope of business. All of them carry the potential to raise the level of conventional technologies held by agrochemical companies through synergy with them, in addition to expanding opportunities for new business.

Genome editing is a cutting-edge “genetic recombination” technology that has been applied for generating GM crop species. In particular, the Clustered Regularly Interspaced Short Palindromic Repeat (CRISPR)/Cas9 technology developed in 2013 is expected to see widespread use in various fields encompassing basic research, medical and agricultural applications. In terms of agriculture, CRISPR/Cas9 technology enables more precise manipulation of genetic sequences compared to conventional genetic recombination technology, resulting in considerably less time needed for crop breeding. Major agrochemical companies have already introduced this technology into their R&D process and obtained some research outcomes.

As of now, the debate about whether to handle crops created using the genome editing in the same manner as existing GM crops in terms of regulation has intensified in Japan, the US, and Europe. It is expected to take substantial time to determine in each country whether genome-edited crops should be subject to the same regulations as conventional GM organisms and to establish a universal direction worldwide. However, the question remains as to how consumers will react to genome-edited crops, that is, public acceptance, even after regulatory issues are settled. The public will demand rational, science-based answers about this issue. Provided that all these issues are properly addressed, the genome editing could become a powerful technology that contributes heavily to improving agricultural productivity through development of high-performance seeds in less time than conventional breeding technologies.

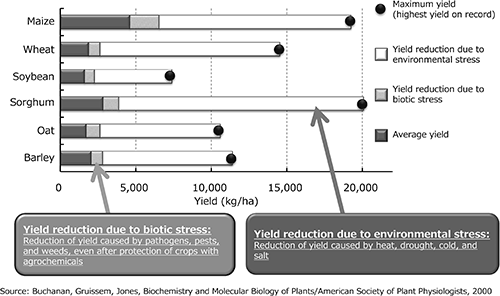

Factors reducing crop yield may be divided into “biotic stress” such as pathogens, pests and weeds, which have been the targets of conventional chemical pesticides, and abiotic “environmental stress” such as heat, cold, drought, and salt damage. Despite the major contribution that conventional agrochemicals have made to boost crop yields by reducing the biotic stressors mentioned earlier, according to an analysis of past maximum yields of individual crops, environmental stressors have been found to impact crop yields more than biotic stressors.13) Managing crop stress is one way to recover yield lost due to environmental stress, and even to increase the yield; indeed, all the agrochemical companies are working to create agrochemical compounds showing activity useful for managing crop stress. Also, some existing agrochemicals reportedly have alternative potential as such ingredients. Furthermore, GM seed products resistant to environmental stress are under development. Crop stress management is an approach with greater potential for improving yield compared to conventional agrochemicals that target biotic stress, and future technological innovation in this field is anticipated.

According to Prof. Shibusawa at Tokyo University of Agriculture and Technology, precision agriculture is defined as “a farm management method to comprehensively improve the yield and quality of crops and reduce environmental load through the tailored control of the complex and diverse variables on a farm, based on facts recorded about the farm”.14) One of the driving forces behind the emergence of precision agriculture is a shift in the direction of cultivation management. The shift is from the conventional approach of pursuing yield increases by using imprecise amounts of crop inputs to a new approach that strives for sustainable agriculture through simultaneously attempting to reduce or optimize chemical usage and improve labor productivity. Another factor is that the recent rapid progress in information technology (IT) and other relevant fields makes the aforementioned cultivation management methods technically feasible. As previously discussed, growth in cultivated land cannot keep pace with an ever-increasing world population, so it is essential to increase crop yield per unit area. As a result, there are great expectations for precision agriculture, along with other relevant technologies to help boost both land and labor productivity.

In this section, three major new technologies have been discussed, namely genome editing, crop stress management, and precision agriculture as novel technological trends. Just like the impact of GM crops on agriculture in the 1990s, these novel technologies have potential to instigate a paradigm shift in the future, and there is high anticipation that these new technical approaches will deliver higher productivity and quality in crop plants. We, as researchers responsible for future R&D, need to keep pace with new technologies and at the same time to seek ways for conventional agrochemicals to harmoniously coexist with emerging technologies.

5. Analysis of trends in research and development (R&D) budgetsWhat follows is a brief discussion on trends in R&D budgets needed to develop new products, including the abovementioned novel technologies, based on published information.

According to the results of the Survey on Science and Technology Research compiled by the Ministry of Internal Affairs and Communications, the research expenditure on science and technology in Japan, which was 16.5 trillion yen in 2001, reached 19.0 trillion yen in 2016, demonstrating an aggregate upward tendency of 2.5 trillion yen (15%) in 15 years. Noteworthy, by research sector, was the life science field. This field includes agrochemical research, and showed remarkable growth from 2.0 trillion yen in 2001 to 3.2 trillion yen in 2014—a 1.2 trillion yen (60%) rise.15)

While an upward tendency was observed in overall R&D expenditure, with a notable spike in the life science field, ongoing efforts are needed to continuously and effectively produce research results with a limited R&D budget. Therefore, while it is fundamental for researchers working at private companies, public institutes, and universities to produce high-quality research outcomes from their respective positions, it is equally important to facilitate collaborative studies and joint applications by disclosing research results. It is also crucial to aggressively promote open innovation toward generating collective outputs greater than the sum of that from individual researchers. Also vital is the effective matching of research outcomes and ideas created in two broadly divided sectors, namely universities and public institutes in charge of basic research and private companies that excel at applied research and product development, via collaborative study and the like. Moreover, swiftly reaching agreement regarding contracts and intellectual property is another factor that can accelerate open innovation.

The “Millennium Development Goals (MDGs),” a United Nations program to support developing countries by setting eight goals for the international community of the 21st century to fulfill, including poverty reduction and attainment of primary education, reached their target date in 2015. The primary aim of the MDGs was to reduce poverty by having advanced nations support economic growth in developing countries through activities such as donations and assistance. The Sustainable Development Goals (SDGs), a new set of next-generation international development goals succeeding the MDGs, were established under agreement among members of the United Nations and comprise a collection of 17 global goals along with the associated 169 specific targets regarding poverty, hunger, and health. The key feature of the SDGs is addressing not only problems specific to developing countries, as included in the MDGs, but also global challenges affecting developed nations. The aim of the SDGs is to improve people’s living conditions and to change the world for the better.

Meanwhile, the Japan Crop Protection Association (JCPA), on reaching its 60th anniversary in 2013, started to create an ideal vision for its future and eventually formulated an initiative called “JCPA Vision 2025,” in 2014. Based on this vision, JCPA will conduct public relations activities targeting consumers, the media and educational experts as well as safety activities aimed at farmers and distributers to promote public understanding of agrochemicals. Moreover, to strengthen activities focused on food production, the Association will endeavor to distribute information on “The Significance of Food Production and the Role of Agrochemicals.” More specifically, JCPA will distribute information on the following agendas to farmers, distributers, consumers, public administrators and academics: (1) increasing food production and ensuring stable food supplies are universal tasks which must be done to feed a growing global population; (2) agrochemicals are indispensable resources for effectively producing high-quality crops on the limited amounts of cultivated lands to achieve agenda-(1); (3) scientific data, such as safety assessments that comply with international guidelines, supports the application of agrochemicals; and (4) agrochemicals should not cause any problems if used properly and as registered.

Furthermore, JPCA Vision 2025 activities complement the SDGs.16) Securing quantity as well as quality in agricultural crops with agrochemicals can contribute to SDG Goal 2, “Zero Hunger,” by helping to end global hunger and promoting sustainable agricultural practices. Promoting sustainable agricultural practices with agrochemical applications can also contribute to Goal 15, “Life on Land,” through helping to protect the richness of the natural green environment by preventing unnecessary expansion of cultivated land. In addition, Goal 8, “Decent Work and Economic Growth,” can be supported by using agrochemicals that enable more effective and stable agricultural activities and results to transforming agriculture into a growth industry. Furthermore, JPCA Vision 2025 can support SDG Goal 3, “Good Health and Well-Being for People,” by using agrochemicals to reduce the risks posed by mycotoxins, which are produced by certain types of plant pathogens, to maintain good health in people. Some active ingredients of agrochemicals are also effective as agents for controlling pests that threaten good hygiene, making them useful in maintaining public health and potentially contributing to Goal 3. One of the stewardship activities, “Safety Activities for Farmers” connects to Goal 12, “Responsible Consumption and Production;” other activities “Public Relations with Consumers” and “Activities Toward Internationalization” link to Goal 17 “Partnerships for the Goals;” and another, “Creation of New Products and Technologies” complements Goal 9, “Industry, Innovation, and Infrastructure.”

It has been shown that crop yields obtained without the use of agrochemicals are substantially lower than those with agrochemicals, although some variations have been observed in the degree of reduction by crop, such as 76% for rice, 70% for soybeans, 33% for cabbages, 30% for peaches, and as low as 3% for apples. Therefore, it is expected that maintaining crop productivity by suitable application of agrochemicals can contribute to Goal 2 of the SDGs, “Zero Hunger.” In another instance, the time needed to weed 10 acres of rice paddies per year was 51 hr in 1949; the same task had plunged to just 1.4 hr by 2012 thanks to the development and promotion of highly effective herbicides. Thus, the development and proper use of high-performance agrochemical can contribute to Goal 8, “Decent Work and Economic Growth,” by boosting the efficiency of agricultural practices and transforming farming into a growth industry.

One of the missions for the future raised in the JCPA Vision 2025, “Contributing to a Stable Food Supply around the World,” and the objective of JCPA, “Creating a Better Society through the Vision Activities,” also link to the SDGs.

In the meantime, CropLife International, an association of 5 major agrochemical companies & Sumitomo Chemical as well as regional crop protection and plant biotechnology associations, is discussing suitable public relations and stewardship activities as well as furthering development of new technologies to highlight the crop protection industry’s contributions to society. In relation to the SDGs, advancing sustainable agriculture and eradicating tropical infectious diseases such as malaria can help to stimulate the growth of developing countries in Asia and Africa, leading to accomplishment of the following SDGs: Goal 1 “No Poverty,” Goal 3 “Good Health and Well-Being for People,” Goal 8 “Decent Work And Economic Growth,” and Goal 11 “Sustainable Cities And Communities.” Also, development of environmentally friendly agricultural materials and progress in precision agriculture are expected to contribute to Goal 13, “Climate Action.”

Agrochemical pesticides have contributed extraordinarily to increasing the productivity of modern agriculture and, the present level of agricultural output cannot be sustained without them. Agrochemical companies are continuing to create and supply new products to support such growth of agricultural productivity, but development of new products has recently become more difficult due to tougher worldwide regulations. On the other hand, agricultural productively has risen further thanks to GM crops, which emerged in the 1990s. This has become a popular technology and now constitutes a large proportion of sales for the major agrochemical companies handling them. In the future, new fields will be explored by novel technical approaches, including creation of new crops via genome editing and establishment of sustainable agricultural systems through precision agriculture.

To support a world population that is projected to reach 9.8 billion by 2050 with limited land available for cultivation, it is imperative to increase crop yield per unit area. Furthermore, the hurdle is high for resolving global food security issues, which is further complicated by the negative impacts of climate change. As discussed above, we, as experts involved in the crop protection industry, must strive to improve agricultural productivity by creating new products and technologies with the aim of helping to solve food problems that the world is facing. In my opinion, these actions are nothing less than sincere efforts to attain SDG Goal 2, “Zero Hunger,” and other relevant objectives.

I am deeply grateful to Dr. Warren Shafer, a Vice President, Global R&D and Regulatory Affairs, Valent BioSciences and Dr. Bill Hendrix, a Vice President, Technology, Valent U.S.A. for insightful comments and suggestions. I also thank Dr. Takashi Hirooka, a Director General, Japan Crop Protection Association for constructive comments on earlier version of this paper.