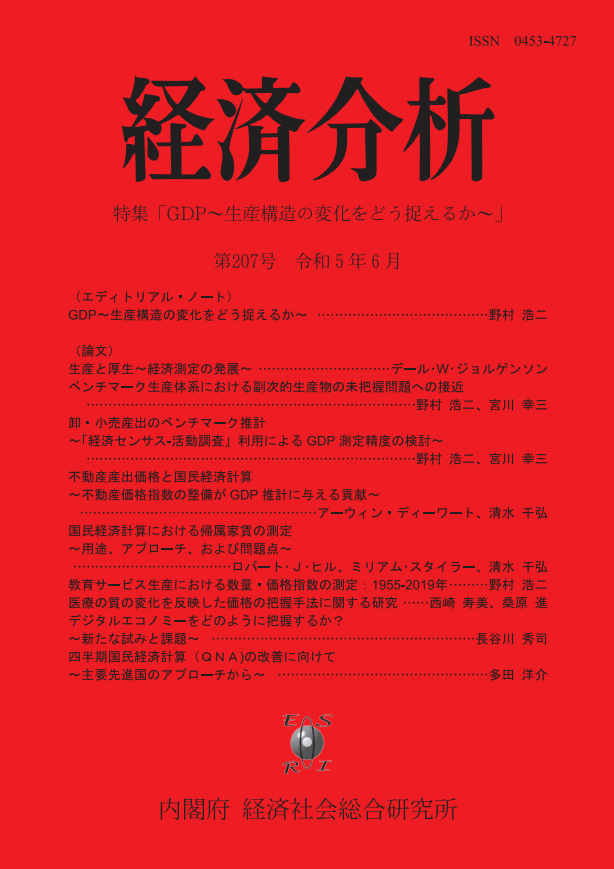

Volume 207

Displaying 1-10 of 10 articles from this issue

- |<

- <

- 1

- >

- >|

-

2023 Volume 207 Pages 1-21

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1231K) -

2023 Volume 207 Pages 22-85

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (2576K) -

2023 Volume 207 Pages 86-120

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1164K) -

2023 Volume 207 Pages 121-144

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1564K) -

2023 Volume 207 Pages 145-170

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1570K) -

2023 Volume 207 Pages 171-190

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1391K) -

2023 Volume 207 Pages 191-219

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1727K) -

2023 Volume 207 Pages 220-249

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1245K) -

2023 Volume 207 Pages 250-281

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (2074K) -

2023 Volume 207 Pages 282-323

Published: June 30, 2023

Released on J-STAGE: December 13, 2023

Download PDF (1726K)

- |<

- <

- 1

- >

- >|